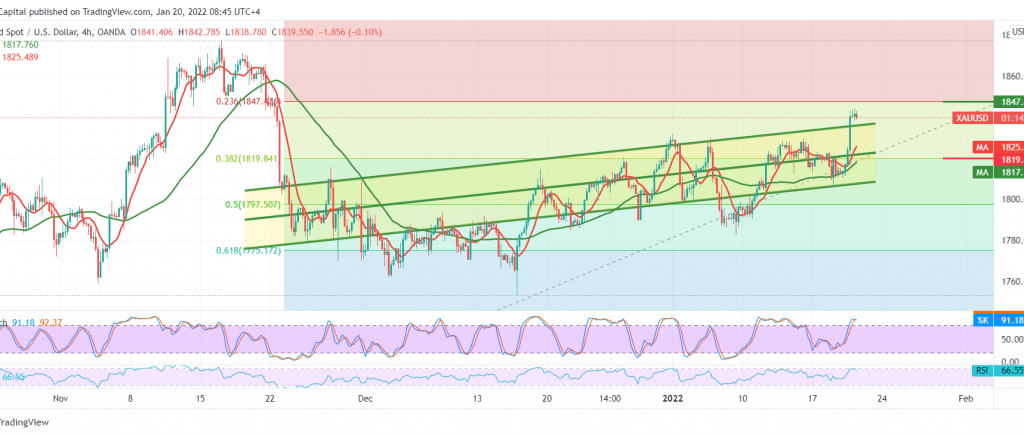

Gold prices achieved noticeable gains and reversed the bearish trend as we expected, in which we relied on trading stability below the 1820 resistance level, recording the highest level at 1844.

Technically, trading above the previously breached resistance-into-support at 1820 price supports the possibility of the upside and price movements above the 50-day simple moving average, accompanied by positive signals from the RSI.

The bullish scenario is the most preferred today. Still, the breach of 1847 is an important and basic condition for the continuation of the rise, with initial targets starting at 1852, and gains may extend later towards 1865.

The decline below the mentioned support level can postpone the suggested bullish scenario, and we may witness a retest of 1797, 50.0% correction.

Note: The risk level is high.

Note: Stochastic is trading around overbought areas.

Note: CFD trading involves risks; all scenarios may occur.

| S1: 1818.00 | R1: 1852.00 |

| S2: 1797.00 | R2: 1865.00 |

| S3: 1784.00 | R3: 1886.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations