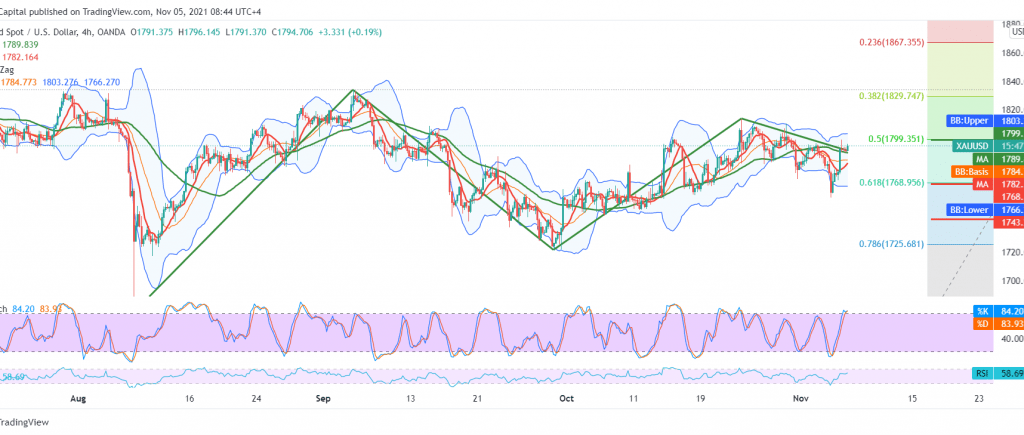

A bullish rally was witnessed in gold prices during yesterday’s session, nullifying the negative outlook as we expected. Therefore, we relied on the intraday instability below the 1799 resistance level after on the main support level 1768.

On the technical side, there is a conflict between the technical signals, we find the simple moving averages returned to hold the price from below, supporting the bullish price curve, accompanied by the RSI gaining bullish momentum on the short time frames, and this contradicts the apparent negative features on the stochastic indicator.

As a result of the aforementioned conflict, we prefer to remain neutral, waiting for one of the following scenarios:

To confirm the daily positivity, we need to witness price stability above 1799 represented by 50.0% Fibonacci correction to enhance the chances of rising towards 1805 and 1816 next stations.

Reactivating the selling positions requires the infiltration below the support level of 1776 and most notably 1768 Fibonacci correction of 61.80%, which forces the bearish trend to impose its control on gold prices, opening the way directly to visit 1757 and 1747 respectively, and losses may extend towards 1735.

| S1: 1776.00 | R1: 1799.00 |

| S2: 1768.00 | R2: 1805.00 |

| S3: 1747.00 | R3: 1816.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations