The strong support levels published during the previous analysis at 1745 could limit the bearish tendency that gold prices witnessed today to end its daily dealings above the mentioned level.

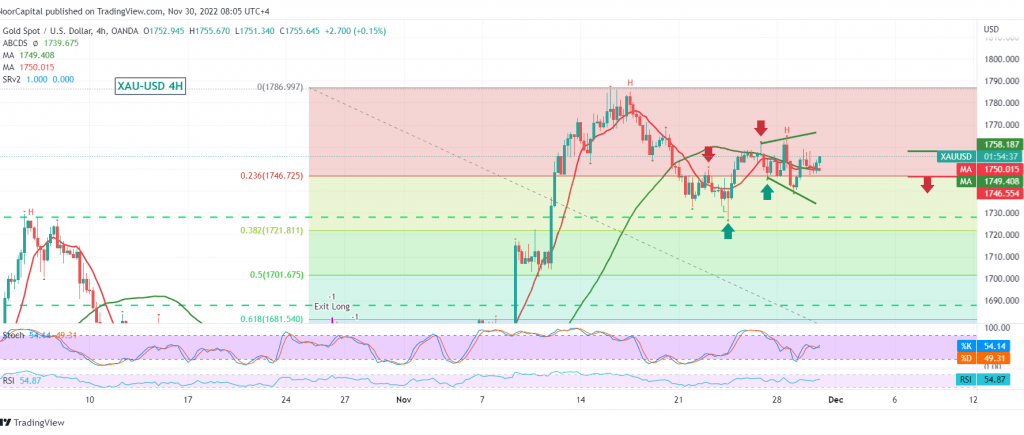

Technically, gold prices retreated to the downside to test the floor of the pivotal support published yesterday at 1745, and the prices are still stable above. With a close look at the 4-hour chart, we find the Simple Moving Average 50 returned to hold the price from below, and we see the stochastic indicator trying to Get rid of momentary negativity.

Although we tend to be positive, we prefer confirming the breach of the minor resistance located at 1756, which is a catalyst that can consolidate gains towards 1762 and 1770, respectively, considering that price consolidation above 1770 opens the way directly towards the main resistance 1777.

We remind you that breaking 1745 leads gold prices to a daily bearish trend, its initial target is 1738 and 1732, while its official target is located around 1726.

Note: Today we await high-impact data from the US economy, in addition to the speech of “Jerome Powell” Chairman of the Federal Reserve, and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations