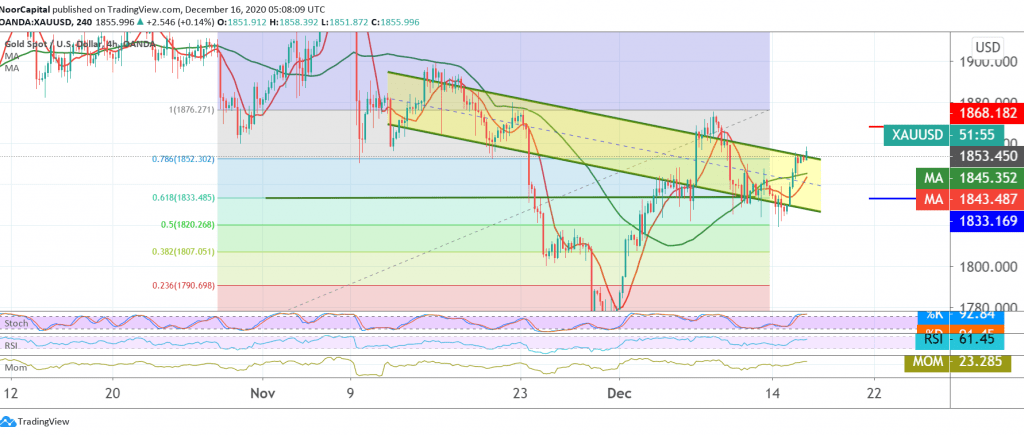

We committed to the intraday neutrality during the previous analysis due to the contradictory technical signals, to find that gold prices witnessed positive moves, negating the bearish tendency to reach its highest level during the Asian session at 1858.

On the technical side, and with a closer look at the 4-hour chart, we find gold succeeded in building on the solid support floor located at 1833 represented by the 61.80% Fibonacci, which increases the probability of the rise, in addition to the stability of the RSI above the 50 midline on the short time frame.

From here, with the stability of daily trading above 1833, the bullish bias is likely today, targeting 1867/1870, and we are content with this target only due to the high level of risks around these levels.

A reminder that trading again below 1833 forces the price to make concessions targeting a re-test of 1820, an initial 50.0% correction.

Note: Stochastic around overbought areas.

| S1: 1833.00 | R1: 1867.00 |

| S2: 1813.00 | R2: 1880.00 |

| S3: 1807.00 | R3: 1900.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations