Gold Hits Record Highs Before Facing Profit-Taking Pressure

Gold prices extended their rally in the previous trading session, surpassing the key $2,950 per ounce target and reaching a new high of $2,954.

Technical Analysis

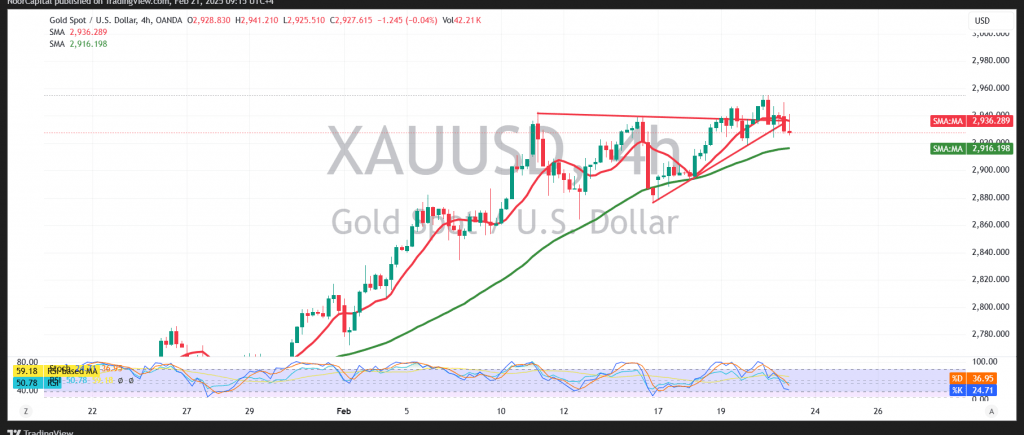

Despite the strong long-term bullish trend, intraday movements indicate a bearish pullback due to profit-taking and overbought conditions signaled by the Stochastic indicator.

On the 4-hour chart, the simple moving averages (SMA) continue to provide support within an ascending price channel, reinforcing the broader upward trend.

However, in the short term, price fluctuations may lead to a retest of $2,915, possibly extending to $2,904 before renewed bullish momentum emerges. A confirmed breakout above $2,950 would signal further gains, targeting $2,965 and beyond.

Market Risk and Caution

With ongoing trade tensions and heightened volatility, traders should remain cautious. All scenarios remain possible, and risk management is crucial in navigating market movements.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations