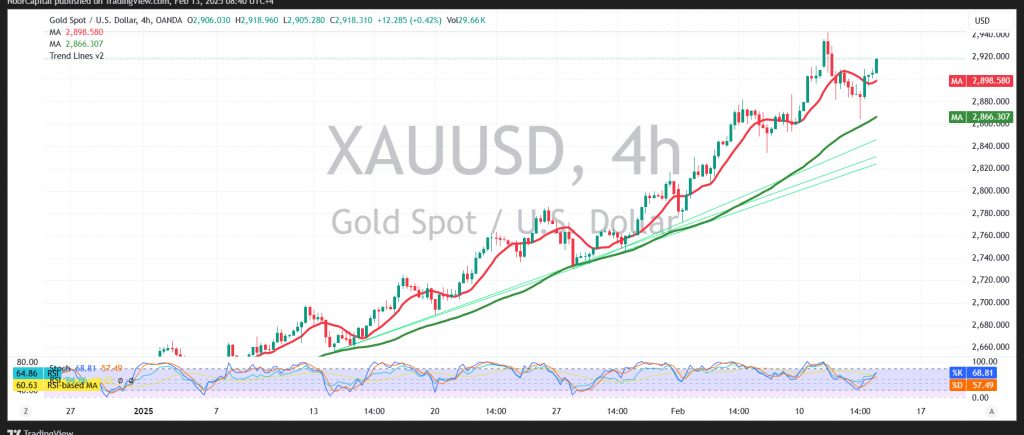

Gold Price Analysis

Gold successfully retested the 2870 support level and closed above it, initiating an upward move in today’s session, reaching $2918 per ounce.

Technical Outlook:

- Bullish Indicators:

- Simple moving averages support the continuation of the upward trend.

- The 14-day momentum indicator signals positive momentum.

- Bearish Risk:

- A drop below 2870 could put gold under negative pressure, potentially leading to a retest of 2845 – 2840.

Key Levels to Watch:

- Bullish Scenario:

- Above 2880 (and ideally 2870), gold remains in an uptrend.

- A break above 2935 could accelerate gains toward 2953.

- Bearish Scenario:

- A break below 2870 may trigger a decline toward 2845 – 2840.

Market Risks & Considerations:

- Upcoming US economic data (Producer Price Index, Weekly Unemployment Claims) may cause high volatility in gold prices.

- Ongoing trade tensions add uncertainty to market movements.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations