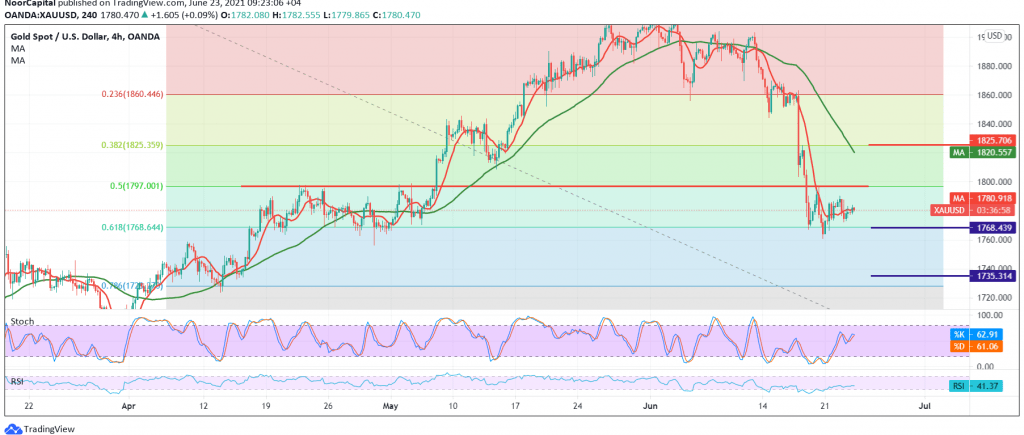

The resistance level published during the last analysis, located around 1797, was able to limit the bullish tendency witnessed by gold prices yesterday, which forced it to trade negatively again within a gradual decline to the downside approaching by a few points from the first official target 1770, recording its lowest price at 1772.

Technically, and with careful consideration on the chart, a 4-hour time frame is preferred, with intraday trading remaining below 1780, and in general below 1797, 50.0% Fibonacci correction that supports the continuation of the bearish bias, and this comes as the RSI continues providing negative signals.

Therefore, we will maintain our negative outlook, targeting 1768, 61.80% correction, a first target, and breaking it will extend gold’s losses, so that the road will be directly open towards 1758, and it may extend later towards 1734, the official target for the current downside wave.

Only from the top is to cross up and rise above 1797, and most importantly 1800 is leading the price to a temporary ascending path with its target 1825.

| S1: 1765.00 | R1: 1788.00 |

| S2: 1758.00 | R2: 1802.00 |

| S3: 1744.00 | R3: 1810.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations