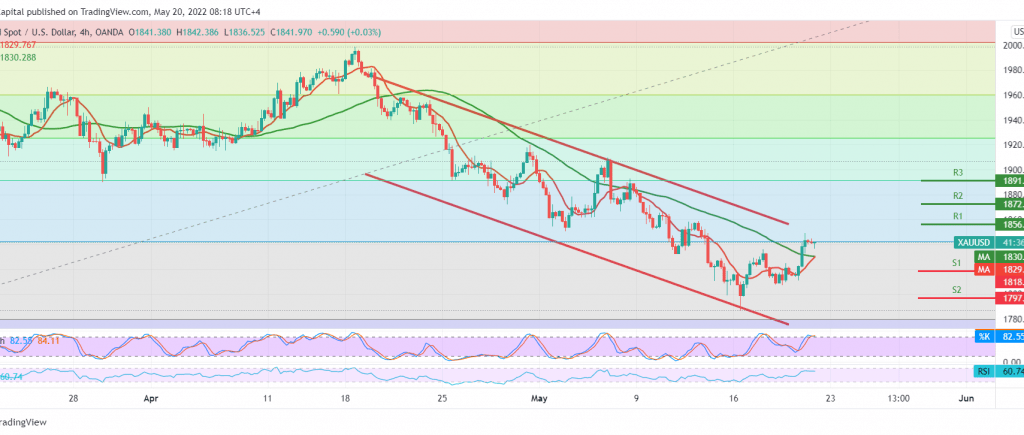

Positive movements dominated gold prices to reflect the temporary bearish trend referred to during the previous report, in which we relied on the stability of trading below 1830, and to remind us, we explained yesterday that skipping upwards above 1830 leads gold directly to visit 1842, recording the highest 1849, compensating the short position.

On the technical side, the movements on the short time frames are witnessing stability above the 1830 resistance. The 05-day SMA still provides a positive incentive that supports the possibility of continuing the rise.

From here, and with the intraday trading remaining above 1830, the bullish scenario remains valid and effective, provided that the 1850 breach is confirmed, and that is a catalyst factor that enhances the chances of achieving gains towards 1857 and 1872, respectively.

Activating the proposed scenario mainly depends on the stability of trading above 1830 and most importantly 1827, and the decline below the mentioned levels puts the price under negative pressure again, waiting for the visit of 1818 and 1810, respectively. Note: Stochastic is trading around overbought areas. Warning: the level of risk may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations