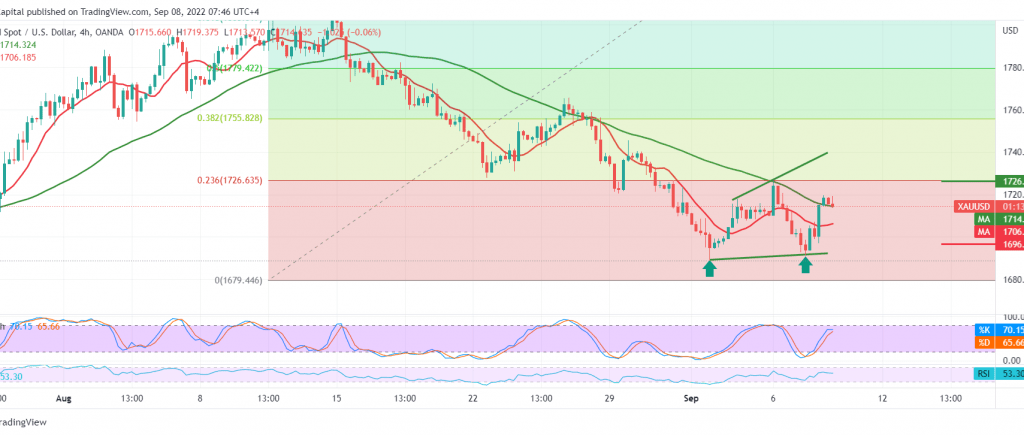

Gold prices found a solid support floor that succeeded in establishing it near 1796, to witness a trading session that tilted to the positive after gold succeeded in confirming the breach of the 1705 resistance level, explaining that consolidation above the mentioned level leads the price to visit our first bullish target 1715, recording its highest level during the last trading session 1719.

Technically, and carefully looking at the 4-hour chart, we find the simple moving averages trying to push the price higher, and this comes with the success of gold in breaching the 1705 resistance.

From here and steadily intraday trading above 1705 and in general above 1796, there may be a possibility to resume the bullish bias to visit the first target, 1726 represented by the 23.60% Fibonacci correction. It should be noted that the breach of 1726 is a catalyst that can enhance gold gains, opening the door directly towards 1737 initially.

Trading stability below 1796 will immediately stop the current attempts to rise and renew opportunities for negative pressure, and we are waiting for an ounce of gold around $1680.

Note: The ECB rate decision, press conference, MPC statement, and Fed Chairman’s speech are due today; all could lead to price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations