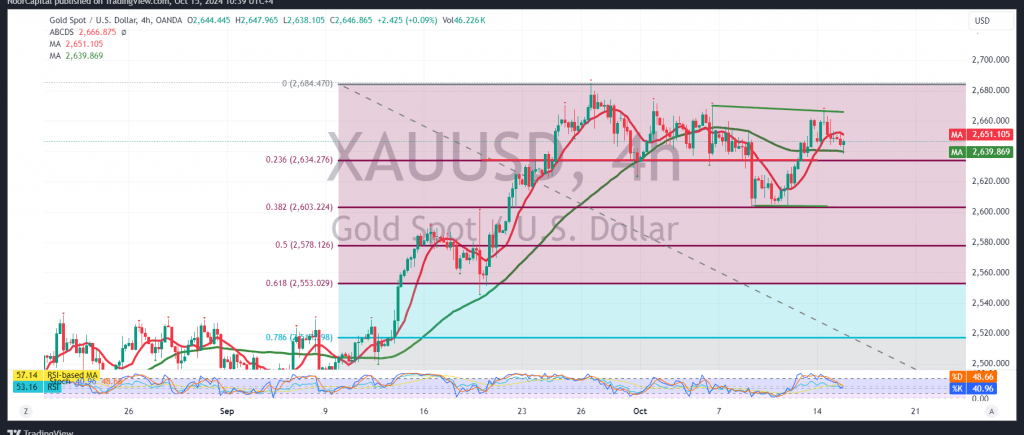

Gold prices declined during the morning session, failing to break through the resistance level of 2666 and approaching a retest of 2635. The lowest price recorded so far is $2638 per ounce.

Today, we lean toward a positive outlook, primarily relying on the price stability above the key support level of 2635, which aligns with the 23.60% Fibonacci correction. This support, coupled with the simple moving average’s attempt to push the price higher and the oversold signals, suggests a potential bullish move.

As long as the price holds above 2635, the upward trend remains the most likely scenario, with targets at 2661 and 2668. Should the upward momentum continue, the price could further extend toward 2677.

On the other hand, a confirmed break below 2635 could invalidate the bullish scenario, placing the price under temporary negative pressure to test 2621 and potentially 2605 before determining the next direction.

Warning: Risks remain high due to the ongoing geopolitical tensions, and all scenarios are possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations