In a dynamic session of trading, gold prices experienced fluctuations, influenced by the strengthening of the US dollar following the Federal Reserve Committee’s announcements. Despite initial setbacks, gold surged to reach its peak at $2032 per ounce, showcasing resilience amidst market pressures.

Technical Analysis Insights

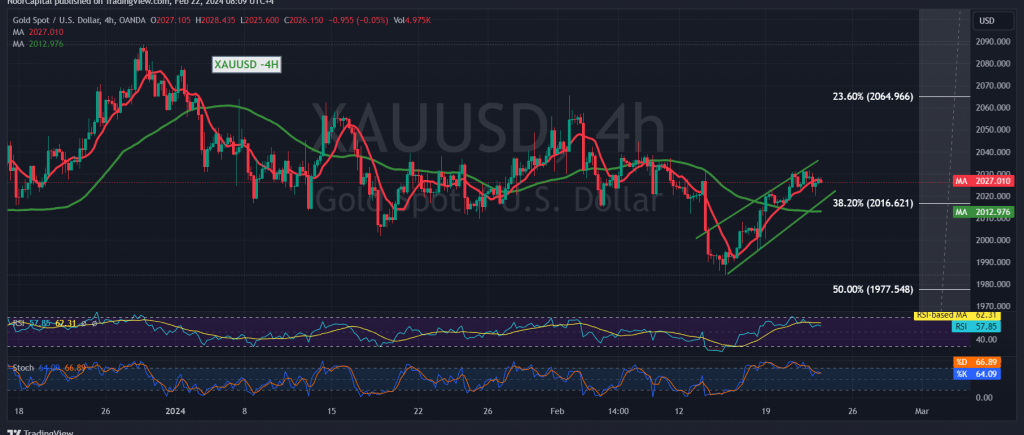

A comprehensive analysis of the 240-minute timeframe chart reveals intriguing dynamics within the gold market. Gold continues its consolidation above previously breached resistance, now transformed into a pivotal support level. This transformation aligns with the concept of exchanging roles, particularly evident at the 2016 price Fibonacci retracement level of 38.20%. Additionally, the 50-day simple moving average exerts upward pressure, fostering positive stability within the market.

Path Ahead: Bullish Outlook

Against this backdrop, an upward trajectory remains the favored scenario for the day. Targets of 2035 and 2041 stand prominently on the horizon, with a breach of 2041 signaling further gains, paving the way towards 2051. It’s crucial to note that the primary target of the ongoing upward wave resides around 2065.

Potential Downside Risks

However, vigilance is warranted. Failure to sustain positive stability above 2016 could expose gold to initial downward pressure. Support levels at 2004 and 2000 emerge as initial targets, with 1977 delineating the official target in the event of corrective declines.

Indicators and Cautionary Notes

The Stochastic indicator endeavors to shed negative signals, indicating potential price fluctuations until a definitive market direction is established.

Economic Data Alert

Market participants are advised to brace themselves for the release of high-impact economic data. From the European economy, anticipation surrounds the preliminary readings of the services and manufacturing PMI indices for France and Germany, as well as the United Kingdom. Concurrently, attention is focused on the United States, where updates on unemployment benefits and the preliminary reading of the purchasing index for both the services and manufacturing sectors are awaited. Expectations of heightened volatility during these news releases persist.

Risk Advisory

Amidst continuing geopolitical tensions, the risk level remains elevated, underscoring the potential for heightened price volatility. Traders are urged to exercise caution and implement appropriate risk management strategies to navigate these uncertain waters.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations