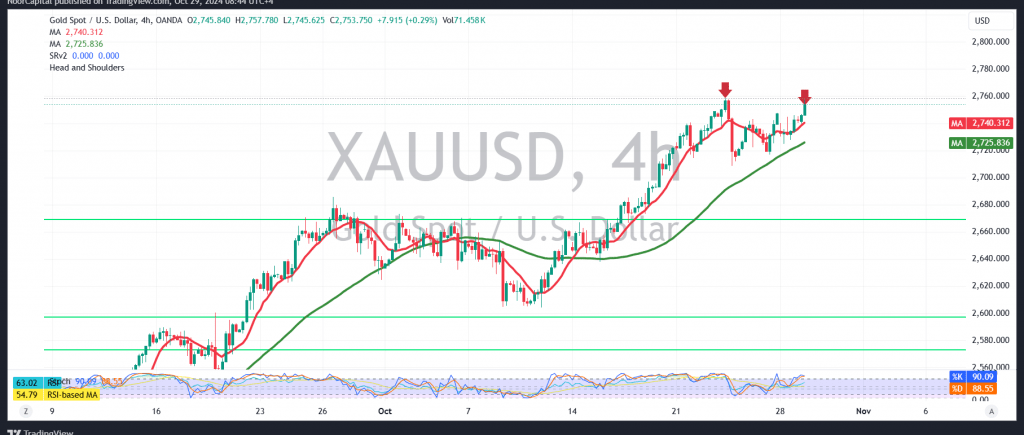

Gold prices are currently showing positive momentum as they attempt to breach the recent peak of $2758 per ounce.

Technical Analysis:

- Analyzing the 4-hour chart, gold has started forming lower peaks, suggesting a potential continuation of a downward correction. The Stochastic indicator is also providing negative signals, indicating a possibility of a temporary decline.

- With daily trading remaining below the $2758 peak, we could see a retest of $2722, which is the first corrective target. If this level is broken, further correction may lead to targets around $2700.

- Conversely, a close of at least one hourly candle above $2758 would invalidate the current bearish outlook, potentially leading to new highs around $2765 and extending towards $2777.

Warnings:

- High-impact economic data from the US, including Consumer Confidence, Job Openings, and Labor Turnover, is expected today. This may lead to increased price volatility during the news release.

- The overall risk level remains high due to ongoing geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations