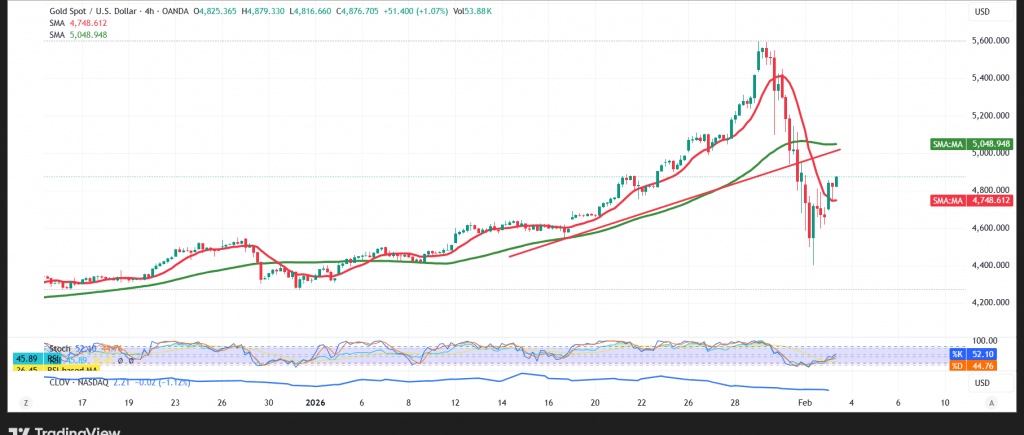

Gold prices (XAU/USD) staged a notable rebound after a sharp sell-off, finding strong support near the 4,400 level. This rebound helped ease selling pressure and triggered a short-term recovery in price action.

Technical Outlook – 4-Hour Chart

Daily Trend: Still Bearish

Despite the recent bounce, the broader daily trend for gold remains clearly downward. Simple moving averages continue to cap price action from above, acting as dynamic resistance and preserving the short-term bearish structure. This is further reinforced by the prior break of the ascending trendline support, as highlighted on the chart.

Short-Term Momentum Improvement

The Relative Strength Index (RSI) is delivering strong positive signals after emerging from oversold territory, explaining the current rebound. However, these signals remain corrective in nature and do not yet indicate a trend reversal unless the daily structure shifts.

As long as daily trading remains below the pivotal 5,000 resistance level, the bearish scenario remains the most probable path. A confirmed break below 4,600 would reinforce downside pressure, opening the way toward 4,546 as a first target, followed by 4,320.

On the other hand, a return to stability above 5,000, confirmed by an hourly close, would warrant caution. Such a move could trigger a stronger recovery toward 5,028 and potentially 5,197.

Risk Warning:

Gold trading currently carries a relatively high level of risk and may not be suitable for all investors. Ongoing trade and geopolitical tensions continue to elevate uncertainty, keeping all scenarios possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 4546.00 | R1: 5028.00 |

| S2: 4233.00 | R2: 5197.00 |

| S3: 4065.00 | R3: 5510.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations