Gold prices experienced a significant boost in early trading this week, solidifying their position above the key psychological resistance level of $2400 per ounce. Previous technical analysis highlighted the potential for a direct recovery towards $2330 once prices held above $2295, a prediction validated by gold’s recent peak of $2358.

Technical Indicators Favor Further Gains

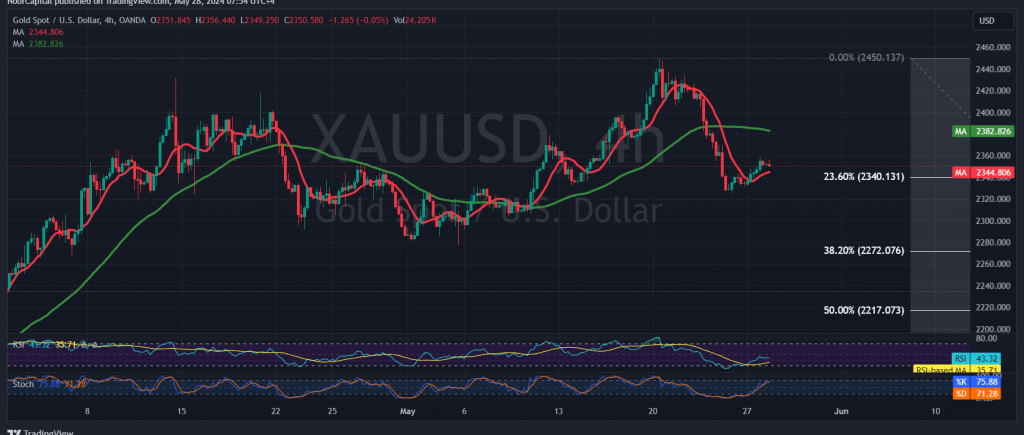

Current technical analysis suggests the upward trajectory is likely to continue. This optimism stems from intraday trading remaining above the $2340 resistance level (representing the 23.60% Fibonacci retracement on the 240-minute chart) and the Stochastic indicator’s attempts to shake off intraday negativity.

Upside Targets and Potential Extension of Gains

The most probable scenario for today’s trading is a continued rise, targeting $2360. If prices consolidate above $2365, the upward trend could strengthen and accelerate, potentially leading to subsequent targets of $2372, $2387, and even $2410.

Downside Risks and Support Levels

However, traders should be aware that a sustained drop below $2340, and more importantly $2335, could reintroduce downward pressure, with an initial target of $2320.

Cautionary Notes:

- US Economic Data: The release of the US Consumer Confidence Index later today may trigger significant price volatility.

- Geopolitical Tensions: Ongoing geopolitical uncertainties could also lead to sharp price fluctuations.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations