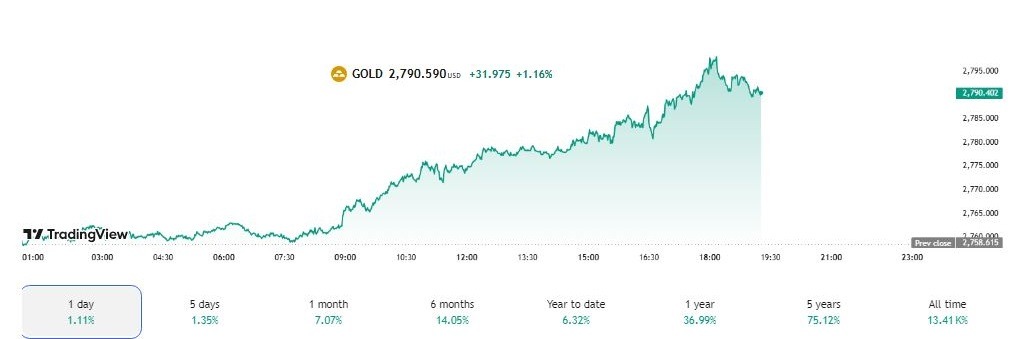

Gold Tests Record Highs as Dollar Weakens

Gold prices are stabilizing above $2,790, building on gains after reaching a fresh record high. The precious metal is approaching the $2,800 threshold as recent macroeconomic developments put downward pressure on the US dollar. This upward movement comes as the European Central Bank (ECB) trimmed interest rates and the US released preliminary Q4 GDP data that fell short of expectations.

Gold Price – Source: TradingView

The ECB lowered key interest rates by 25 basis points, as widely anticipated. This decision brings the interest rate on the main refinancing operations to 2.9%, the marginal lending facility to 3.15%, and the deposit facility to 2.75%. The ECB’s accompanying statement and subsequent press conference indicated continued concerns about economic growth in the Eurozone, while concerns about inflation appeared less pronounced. The ECB’s communication leaned towards a dovish stance, suggesting the possibility of further rate cuts in the coming months.

Concurrently, the US released its preliminary Q4 GDP figures, revealing an annualized growth rate of 2.3%, below the expected 2.6% and the 3.1% growth recorded in the third quarter. The core Personal Consumption Expenditures (PCE) Price Index increased by 2.5% on a quarterly basis, matching market forecasts. Initial jobless claims for the week ending January 24th unexpectedly improved to 207,000 from the previous week’s 223,000. The weaker-than-expected GDP growth data further weakened demand for the US dollar.

Technical Factors:

Gold is approaching its all-time high of $2,790.11 and appears poised to surpass it, targeting the $2,800 level. While some selling pressure may emerge around this psychological barrier, the prevailing market sentiment suggests the bullish trend remains intact. Further near-term gains could propel gold towards the $2,810-$2,820 range.

Potential pullbacks are likely to attract buyers, with near-term support around $2,771.90, the intraday high from January 27th. As long as this support level holds, the bullish momentum is expected to continue.

Whst’s Next for Gold Prices?

Gold’s upward trajectory is being supported by a confluence of factors, including a weakening US dollar, concerns about global economic growth, and the ECB’s dovish monetary policy stance. Market participants will closely monitor upcoming economic data releases and any further communication from central banks to gauge the sustainability of this trend.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations