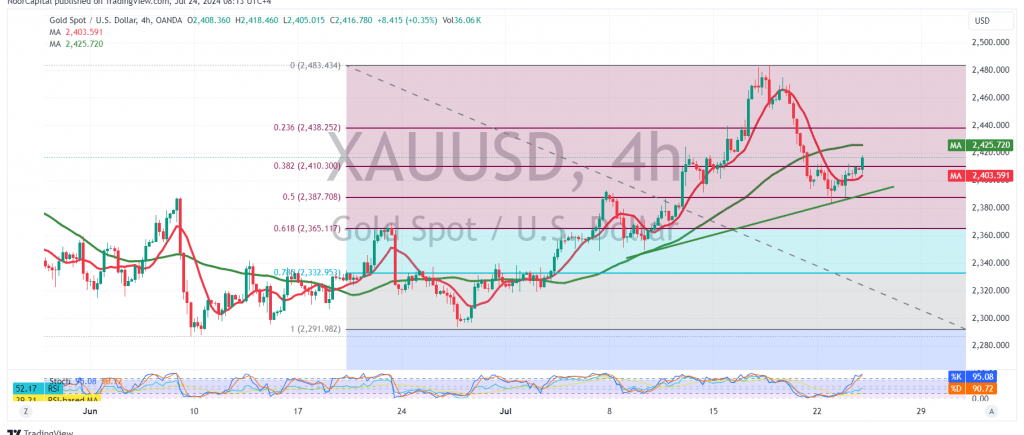

Gold prices started today’s trading session with noticeable positivity after finding strong support near 2388, prompting an upward bounce. Currently, the price is stable around 2416.

From a technical analysis standpoint, the 240-minute chart indicates that the price has stabilized above the 2410 resistance level, aligned with the 38.20% Fibonacci retracement. The Stochastic indicator also shows an attempt to gain additional momentum. However, the 50-day simple moving average remains a potential barrier that could limit further gains.

With these mixed technical signals, it’s crucial to monitor price behavior closely to determine the next trend:

- If the price resumes the downward correction and stabilizes below 2410, the first target would be 2396, followed by 2387 at the 50.0% retracement level. A break below this could lead to further declines towards 2365.

- Conversely, if the price maintains stability above 2410, it may aim for an immediate retest of 2426 and potentially 2438.

Warning: Today’s trading session carries high risk, particularly due to anticipated high-impact economic data releases, including the preliminary readings of the services and manufacturing PMI indices from the Eurozone, the United Kingdom, and the United States, as well as the Canadian interest rate decision and the Bank of Canada’s press conference. These events may result in significant price volatility.

Warning: The level of risk is heightened amid ongoing geopolitical tensions, which may lead to substantial price fluctuations.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations