Gold prices posted a strong advance during today’s morning session, supported by the formation of a solid support base near $3,310—in line with the anticipated bullish scenario. The metal reached the initial upside target at $3,320, with a session high of $3,340 at the time of writing.

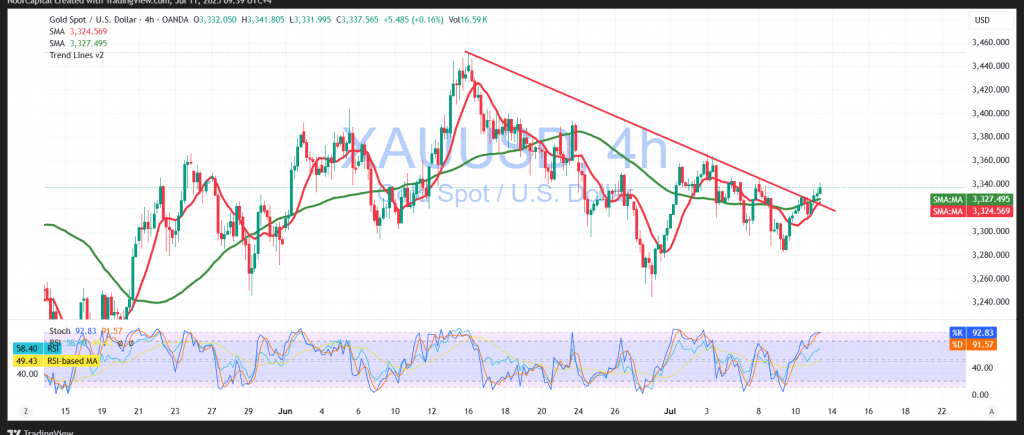

Technical Outlook – 4-Hour Timeframe:

The price successfully broke above the descending trendline, signaling a possible shift in technical momentum. This breakout is reinforced by the alignment of the simple moving averages, which now offer dynamic support. Additionally, the Relative Strength Index (RSI) reflects renewed upward momentum, increasing the likelihood of continued bullish movement.

Probable Scenario:

As long as gold remains above $3,320, and more critically above $3,310, the bullish trend is expected to continue. The next resistance stands at $3,350, and a break above this level could accelerate gains toward $3,360.

Conversely, a drop below $3,310 would invalidate the bullish bias and reactivate the corrective downside scenario, with $3,288 as the initial support level, followed by $3,275.

Caution:

Risk remains elevated amid ongoing trade and geopolitical tensions. Volatility is expected to rise, and traders should manage risk accordingly.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations