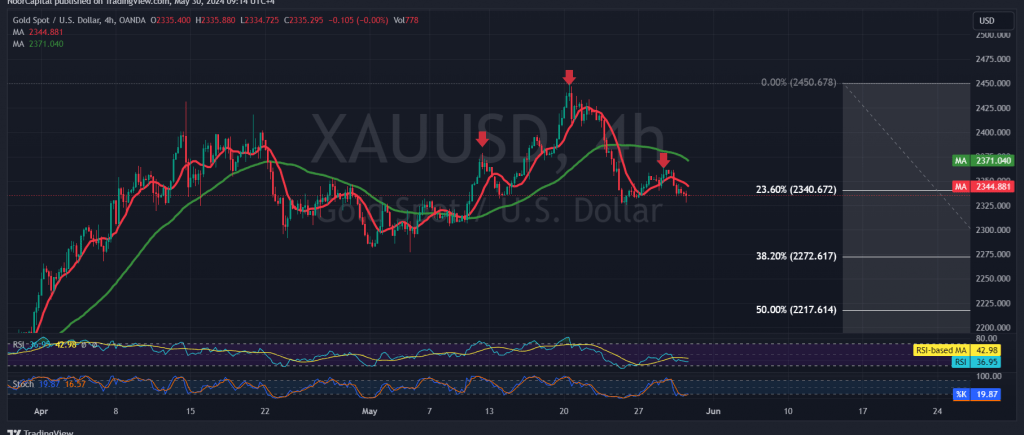

Gold prices have reversed their previously expected upward trajectory, breaking below the critical 2340 support level as outlined in the previous technical report. This development has initiated a bearish turn in the market, with prices currently trading below the 23.60% Fibonacci retracement level on the 4-hour timeframe chart.

Further technical analysis reveals additional bearish signals. The 50-day simple moving average is now acting as resistance, adding to the downward pressure. Moreover, the bearish technical formation on the chart suggests the potential for further declines.

Given these factors, a downward trend is likely to unfold during today’s trading session. The initial target for this bearish move is 2320, followed by 2308. A decisive break below 2308 could accelerate the downward correction, potentially paving the way for a further drop towards 2288.

However, it’s important to note that a price consolidation above 2354 could invalidate the bearish scenario and trigger a recovery in gold prices. In this case, the initial targets for the rebound would be 2360 and 2375.

Caution is advised today, as high-impact economic data releases from the U.S. economy, including unemployment benefits and the preliminary reading of quarterly GDP, are expected. These releases could lead to significant price volatility.

Additionally, the ongoing geopolitical tensions continue to pose a risk of heightened volatility in the gold market. Traders are encouraged to exercise prudence and closely monitor market developments to adapt their strategies accordingly.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations