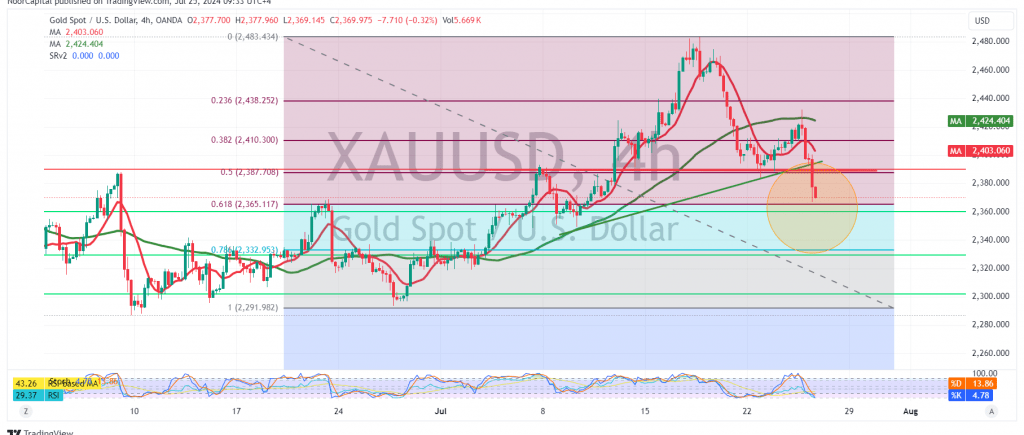

In the previous report, we maintained a neutral stance due to conflicting technical signals, noting that stability above the 2410 resistance level might lead gold prices to target 2426 and 2438. Gold prices reached 2432, achieving the first target.

Today, from a technical perspective, gold prices have rapidly declined after encountering resistance around 2432 and failing to maintain stability above 2410. This movement is accompanied by ongoing negative pressure from the simple moving averages and a bearish technical formation visible on the 4-hour chart.

Given these factors, there is a potential for the downward corrective trend to resume. A break below 2365, the 61.80% Fibonacci retracement, could increase and accelerate the downward momentum, with an initial target of 2349 and a further decline towards 2325.

Conversely, a price consolidation above 2410, corresponding to the 38.20% retracement level, could invalidate the bearish scenario, potentially leading to a recovery attempt with a target of 2465.

Warning: Today’s trading carries significant risk, especially with the anticipated release of high-impact economic data from the American economy, including the preliminary GDP reading, annual revenues, and weekly unemployment benefits. These events may cause considerable price volatility.

Warning: The risk level remains high amid ongoing geopolitical tensions, which could lead to substantial price fluctuations.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations