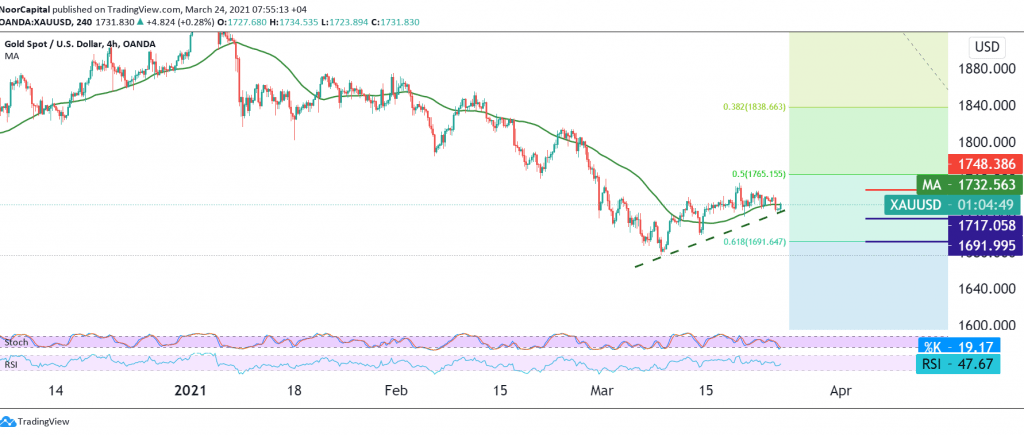

The movements of the yellow metal witnessed a negative bias, after it failed to breach the pivotal resistance published in the previous analysis at 1747, which forced it to retest 1724.

Technically speaking, and with a closer look at the 4-hour chart, we find gold is turning around the 50-day moving average within attempts to rise, on the other hand, we find the clear negative features on the stochastic, which is accompanied by the loss of the RSI indicator, the bullish momentum over short intervals.

We tend to be negative, but we prefer to confirm breaking 1726 to target 1722, knowing that breaking the latter facilitates the mission required to visit 1713, and losses may extend to 1706 later.

From the top, to break to the upside and rise again above 1747, which represents the key to protecting the downside movement over the intraday basis. This negates the suggested bearish scenario, and we may witness a slight upward slope targeting 1756 and 1765, 50.0% correction, .

| S1: 1722.00 | R1: 1741.00 |

| S2: 1713.00 | R2: 1756.00 |

| S3: 1705.00 | R3: 1765.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations