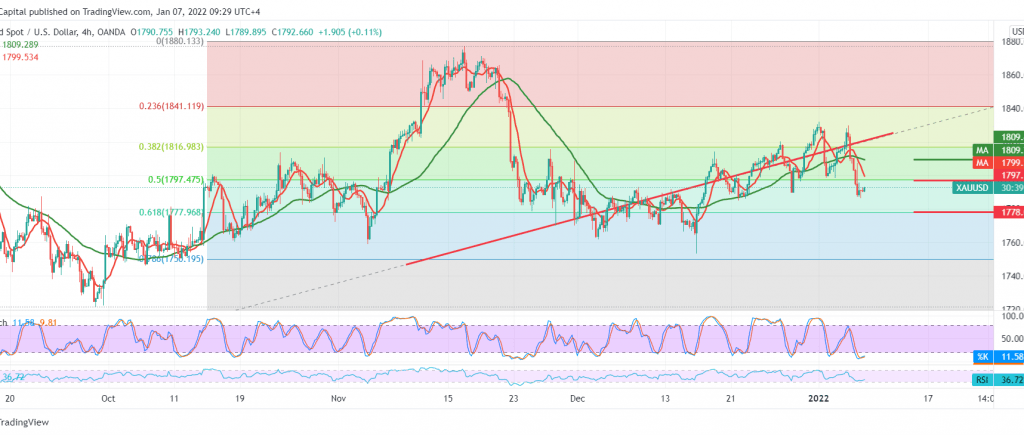

Prices of the yellow metal declined noticeably during the previous trading session after it started to pressure the support level published during the last report, at 1797, gradually approaching the target of 1777, recording the lowest price of 1786.

Technically, today, we notice the continuation of the negative pressure from the simple moving averages, in addition to the price stability below the 1797 level represented by the 50.0% Fibonacci correction.

Therefore, there is a possibility of continuing the decline that started during the last session, touching 1781 initial stations and then 1777 and 1768 expected price stations.

Activating the proposed scenario requires the stability of intraday trading below 1801, and most importantly below 1810, because the confirmation of the recent breach may restore gold to its recovery to retest 1823.

Note: US Jobs Data, average wages, and US unemployment rates are due today and may cause volatility.

Note: all scenarios are on the table.

| S1: 1781.00 | R1: 1806.00 |

| S2: 1777.00 | R2: 1821.00 |

| S3: 1768.00 | R3: 1831.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations