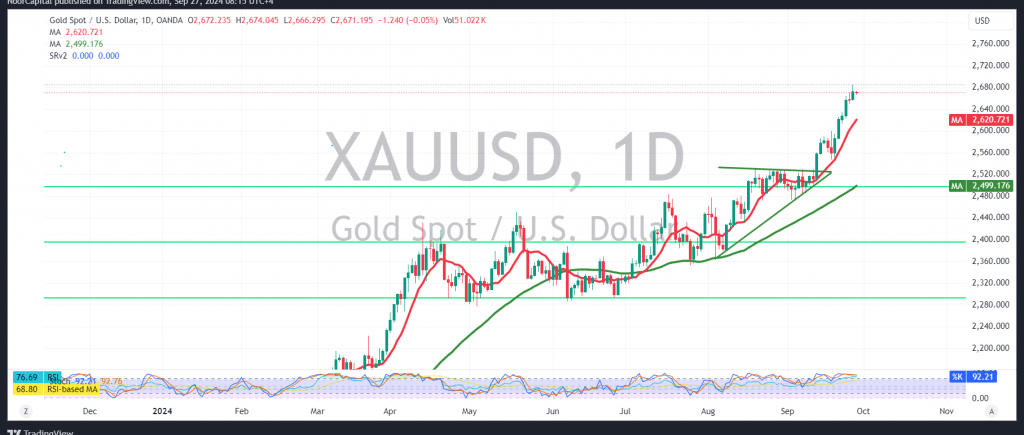

Gold prices continue to reach new historical peaks for the fifth consecutive session, hitting the first target indicated in the previous technical report at 2681, and recording a high of $2685 per ounce.

From a technical analysis perspective today, and by examining the 4-hour chart, gold has established a minor support level around 2655, with the positive incentive from the simple moving averages still supporting the price from below.

For the bullish scenario to remain active, trading needs to stay above 2645. It’s worth noting that an upward move and price consolidation above the 2686 peak would increase and accelerate the strength of the upward trend, with the rise potentially extending towards 2700 and then 2714.

On the downside, slipping below 2645, and more importantly 2642, could temporarily hinder the rise, leading to a downward correction with a target of 2629, potentially extending to 2610.

Warning: The risk level may be high.

Warning: Today, we expect high-impact economic data from the US, specifically “Core Personal Consumption Expenditure Prices – Annual,” which could cause significant price volatility at the time of the news release.

Warning: The level of risk is high amid ongoing geopolitical tensions, and all scenarios are possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations