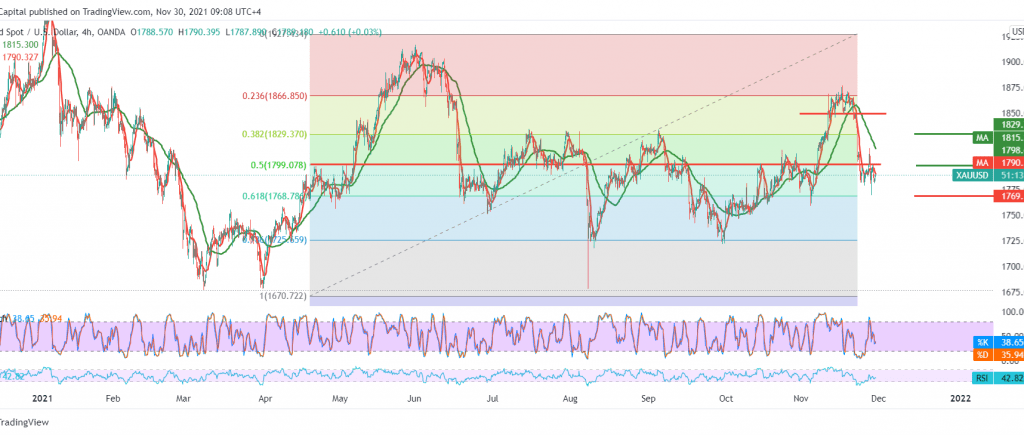

The price metal managed to touch the target published in the previous analysis at 1768, recording its lowest price at 1767, to bounce back up, building on the 1768 support. The price is now hovering around the highest level during the current session, trading at 1788.

Technically, the moves are witnessing attempts to build on the support level of 1768, Fibonacci 61.80%, despite that, we tend to the bearish trend considering the continuation of negative pressure on the simple moving averages with the negative signals coming from the RSI and its stability below the middle line 50.

From here, and with price stability below 1799, the main supply point represented by the 50.0% Fibonacci correction, the bearish scenario remains valid and effective, taking into consideration that the break of 1768 increases and confirms the strength of the daily bearish trend, so that 1759 and 1738 will be the next official stations.

Surpassing the upside and confirming the breach of 1801 may force the price to retest 1808 and 1815 before attempts to decline again.

Note: The risk level is still high.

| S1: 1773.00 | R1: 1801.00 |

| S2: 1759.00 | R2: 1829.00 |

| S3: 1738.00 | R3: 1843.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations