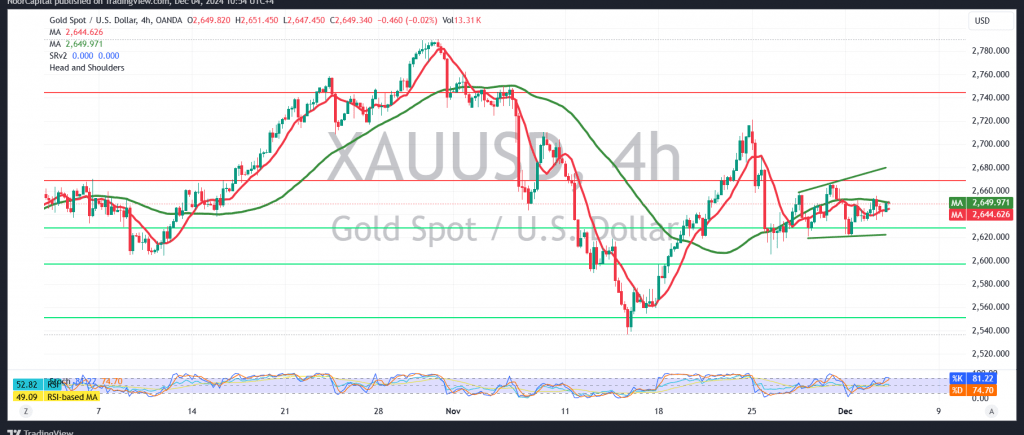

Gold continues to exhibit sideways movement, with prices stabilizing above the support level at 2634 and below the pivotal resistance at 2658.

From a technical perspective, the 4-hour chart reflects conflicting signals. The 50-day simple moving average exerts downward pressure, favoring a bearish trend, while the 14-day momentum indicator provides positive signals, suggesting potential upward momentum in shorter time frames.

Given the conflicting indicators and the confined price range, monitoring price behavior is essential for determining the next movement.

- Bullish Scenario: A breach of the 2658 resistance level could pave the way for gains, targeting 2667 initially and potentially reaching 2679.

- Bearish Scenario: Breaking below 2634 could trigger negative pressure, with the decline extending toward 2625 and 2616 as subsequent targets.

Warning: Today’s U.S. economic data, including “Non-Farm Private Sector Jobs Change,” “ISM Services PMI,” and a speech by Federal Reserve Chairman Jerome Powell, is expected to create significant volatility in gold prices upon release.

Warning: The risk level remains elevated amid ongoing geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations