We remained neutral during the previous session’s trading, explaining that we are waiting for the activation of the pending orders due to the conflicting technical signals at the time of the report’s release, explaining that activating the buying positions depends on confirming the breach of 1666 to target 1677, recording its highest level of 1676.

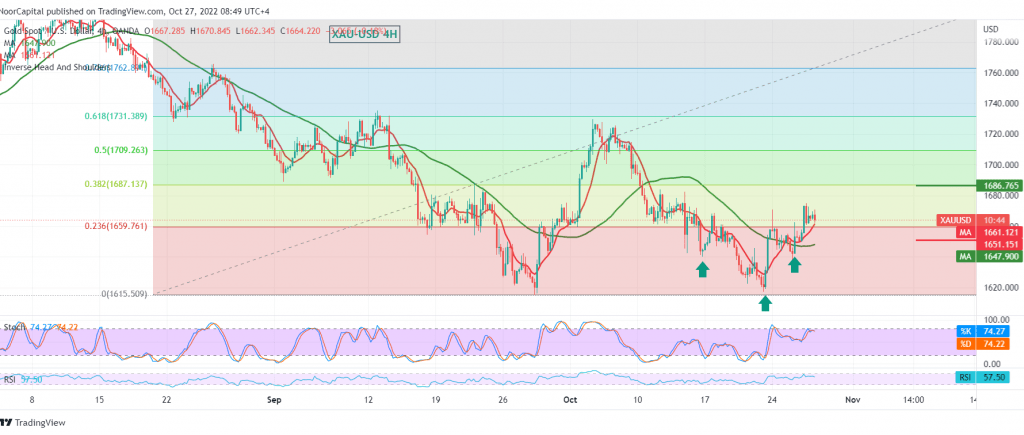

Technically and carefully considering the 4-hour chart, the moving average continues to provide a positive and is motivated by the clear positive signals on the RSI on the 60-minute time frame.

Therefore, the bullish scenario will remain valid and effective as long as intraday trading remains above 1650, targeting 1675 first target, and consolidation above the mentioned level opens the door to 1687, 23.60% Fibonacci correction.

The breach below 1650 constitutes a negative pressure factor on gold prices, and we are waiting for a touch of 1636 initially.

Note: The euro rate decision and European Central Bank press conference are due today. They have an important impact, and we may witness high price volatility and erratic movements.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations