Gold prices saw positive attempts within the expected upward trend mentioned in the previous report, reaching a high of around $2,500 per ounce.

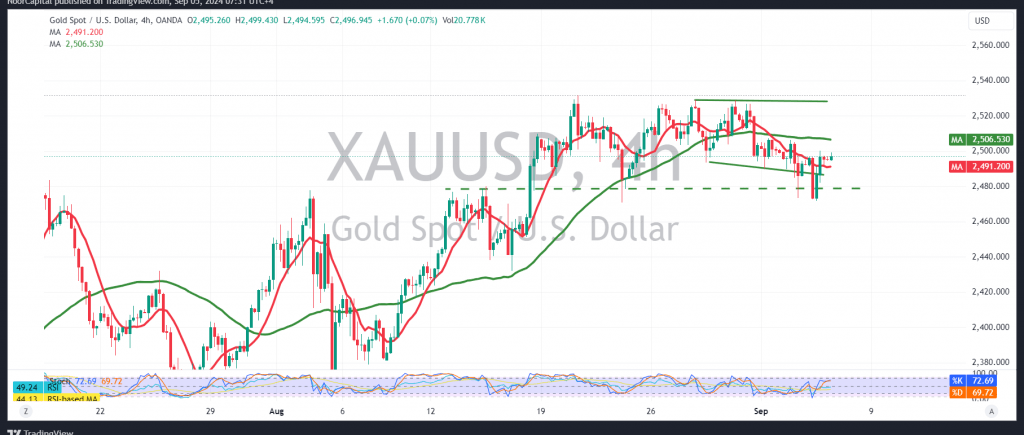

From a technical standpoint today, after achieving the official target of $2,470 earlier this week, we note that the price has stabilized above this level, encouraging clear positive signals on the Relative Strength Index (RSI) for short-term time frames.

There is potential for recovery and a continuation of the main upward trend, provided that the price holds above the psychological resistance level of $2,500. A break above this level could target $2,510, aligning with the 50-day simple moving average, with further gains potentially extending to $2,518 and $2,536.

Conversely, a break below $2,476 could thwart recovery efforts, with gold likely resuming its corrective decline, targeting $2,460 and $2,450 as key levels.

Warning: Risks remain high.

Alert: High-impact U.S. economic data, including “Non-farm private sector jobs,” weekly unemployment claims, and the ISM Services PMI, may trigger significant price volatility today.

Warning: The risk level is elevated amid ongoing geopolitical tensions, which could lead to further price fluctuations.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations