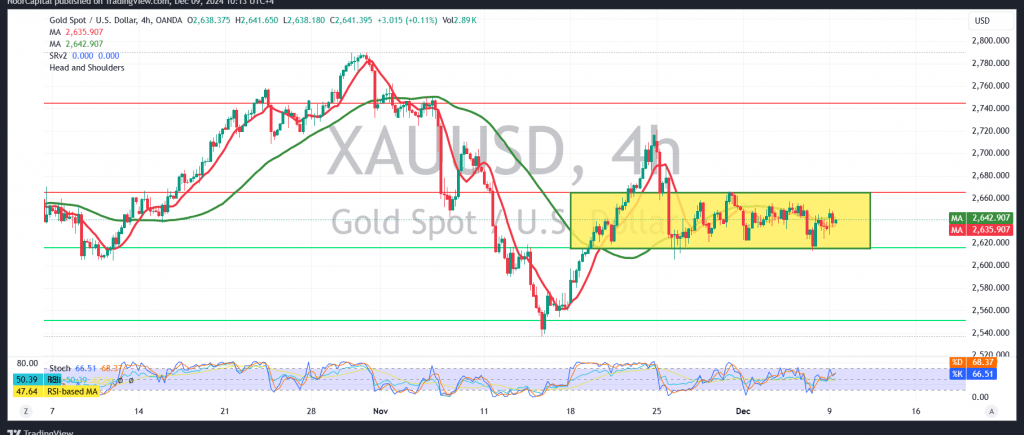

Gold prices continue to trade within a sideways range, remaining constrained between 2620 as support and 2655 as the main resistance level.

Technical Analysis:

- 4-Hour Chart Insights:

- The simple moving average is attempting to provide a positive push to prices.

- Meanwhile, the Stochastic indicator shows persistent negative signals, reflecting conflicting technical cues.

Scenarios:

- Upward Trend:

- A clear and strong breach above the pivotal resistance at 2655 could signal the resumption of the bullish path.

- Targets: 2665, 2671, with potential extensions to 2691.

- Downward Trend:

- Confirming a break below 2620 would likely trigger a corrective decline.

- Targets: 2600, 2581, with further losses possible if momentum accelerates.

Warnings:

- Market Volatility: Risks are elevated amidst ongoing geopolitical tensions, and all scenarios remain plausible.

- Risk-Reward Balance: Traders should evaluate whether the potential returns align with the high level of associated risks.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations