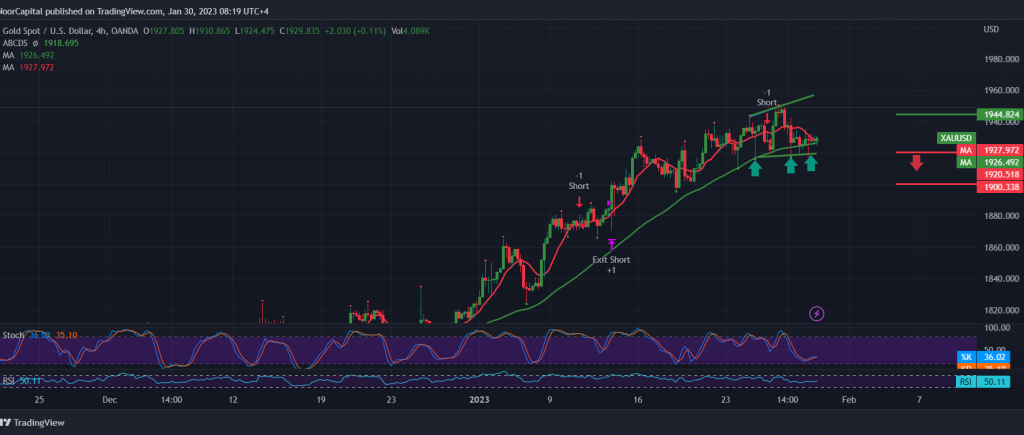

Gold stayed in narrow sideways actions and was confined between 1920 and 1936.

From a technical point of view, today we tend to be positive but with caution, relying on the continuation of the simple moving average’s attempts to provide a positive impulse, in addition to the emergence of positive signs on the stochastic indicator, in addition to the consolidation of trading above the aforementioned pivotal demand point at 1920.

Therefore, the possibility of an increase is still present and effective, but with caution, and we need to witness the price’s consolidation above 1936, which is a catalyst that facilitates the task required to visit 1945 and 1950, respectively.

As a reminder, breaking 1920 can thwart the rise’s completion and put gold under strong negative pressure to start a corrective decline, with targets around 1907 and 1900, respectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations