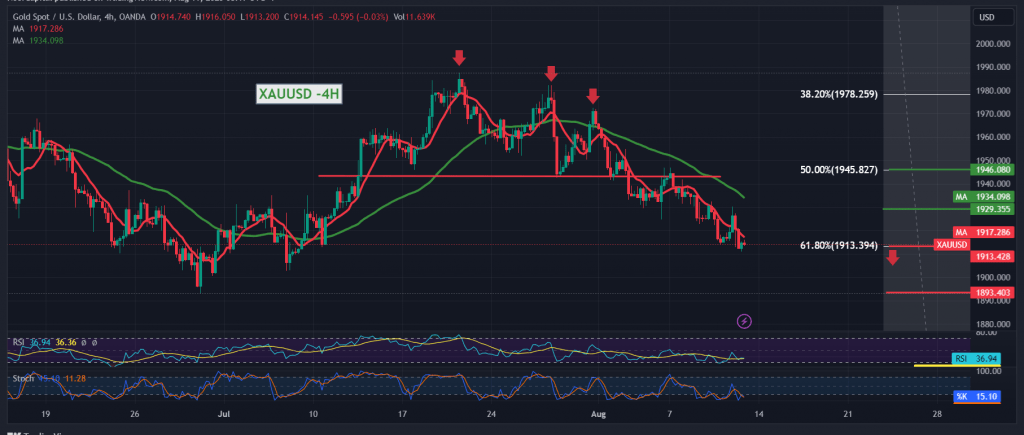

The resistance levels posted during the previous repor at 1929, could limit the bullish bias, which forced gold prices to maintain the bearish path, recording its lowest level at $1910 per ounce.

On the technical side today, and looking at the 4-hour chart, the Simple Moving Averages are still a solid impediment to gold prices and continue to exert negative pressure on the price from above, in addition to signs of declining momentum on the short time frames.

From here, with steady daily trading below 1929, the bearish scenario remains the most likely during the current session’s trading, knowing that the price’s consolidation du 1913 correction of 61.80% facilitates the task required to visit 1906 and 1898, initial stations that extend later to visit 1886, a main target.

Suppose prices fail to achieve a real breach of 1913 level and return to consolidation above 1929. In that case, there may be a possibility for a bullish trend, aimed at retesting the pivotal resistance of the 1945 50.0% correction before determining the next price destination.

Note: Today, we are waiting for high-impact economic data issued by the US economy, “Producer Price Index,” and “Initial Consumer Confidence”, and from England, we are waiting for the “Gross Domestic Product” indicator, and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations