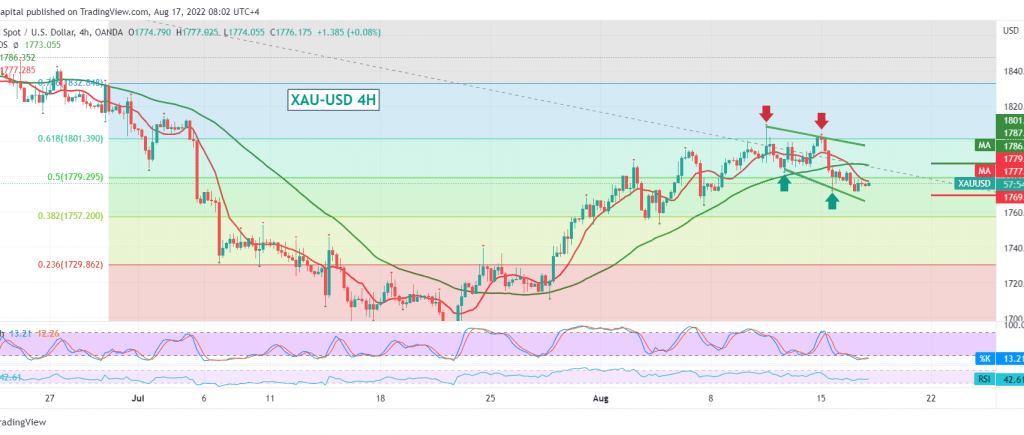

Negativity dominated the gold price movements after it failed to maintain its positive stability above the strong gold level at 1779, recording its lowest level at 1771.

Technically, by looking at the 4-hour chart, we find a conflict in the technical signals. We found the simple moving averages pressing the price from the top, in addition to the stability of the intraday trading below the 1779 level, 50.0% correction, with limited momentum, which supports the possibility of a decline on the side. On the other hand, we find the momentum indicator is trying to eliminate the current negativity and provide positive signals that might motivate the price to rise again.

Therefore, we prefer to monitor the price behaviour to be in front of one of the following scenarios:

Confirmation of breaking 1771 puts the price under negative pressure, and we may witness the ounce around 1756 and 1752, as for consolidation again above 1779 with the confirmation of the breach of 1781, that is a catalyst enhances the chances of rising towards 1788 and 1793.

Note: UK inflation data, US retail sales data, and the results of the Federal Reserve meeting are due today, which are high-impact data; we may see high volatility in prices and all scenarios are on the table.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations