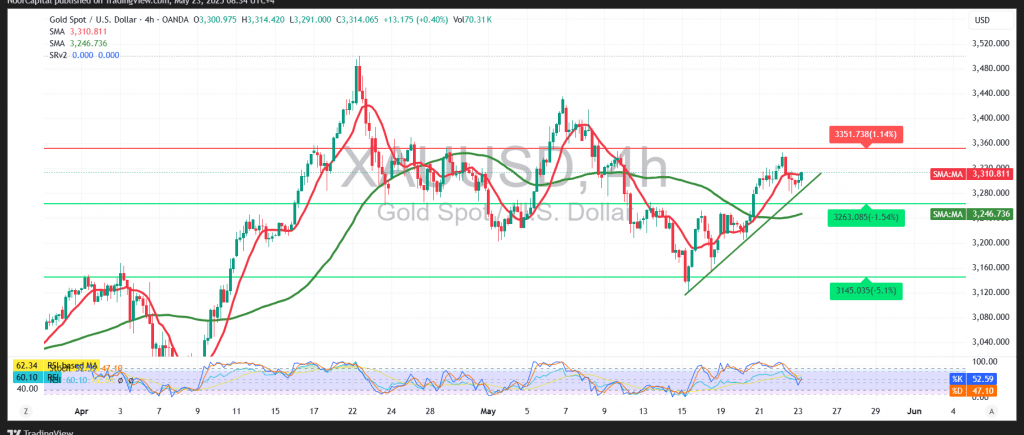

The key support level at $3,260, highlighted in the previous report, successfully limited the downside in gold prices during the prior session. Early European trading today has opened with a stable advance above the psychological $3,300 level, reinforcing the bullish structure.

From a technical perspective, the uptrend remains intact. The Relative Strength Index (RSI) continues to gain upward momentum, holding above the 50 midline, while the simple moving averages have formed a positive crossover, supporting continued upside movement.

As long as gold maintains consistent trading along the ascending trendline and remains above the $3,270 support level, the bullish bias is favored. The next upside targets are set at $3,345–$3,350, with a break above this zone opening the path toward $3,380.

However, a failure to hold above $3,270 would weaken bullish momentum and could initiate a downward corrective phase. In that scenario, initial support levels are located at $3,246 and $3,212.

Risk Disclaimer:

Given ongoing global trade tensions and economic uncertainties, market risk remains elevated. Traders should be prepared for heightened volatility and consider all potential scenarios.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations