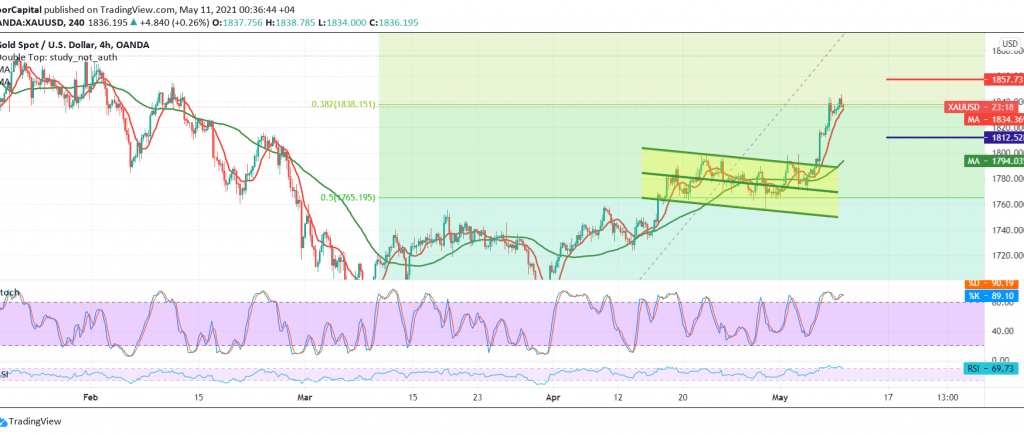

Negative trading dominated gold prices in the context of the re-test published during the previous analysis, after it found it difficult to breach the resistance level of 1843, to record its lowest level at 1831.

On the technical side today, and with a closer look at the 60-minute chart, we tend to bear the bearish bias, relying on the continuation of trading stability below 1843, in addition to stochastic gradually losing the bullish momentum.

Consequently, 1830 is the next target and breaking it extends the losses of gold, so that the way is extended to visit 1823 and then 1815, respectively.

Activating the bearish scenario requires stability below 1843/1845, and confirming its breach is capable of thwarting the bearish corrective tendency, and gold regains the official bullish path again with the first goal of 1851 and 1856, respectively.

| S1: 1829.00 | R1: 1843.00 |

| S2: 1823.00 | R2: 1851.00 |

| S3: 1815.00 | R3: 1858.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations