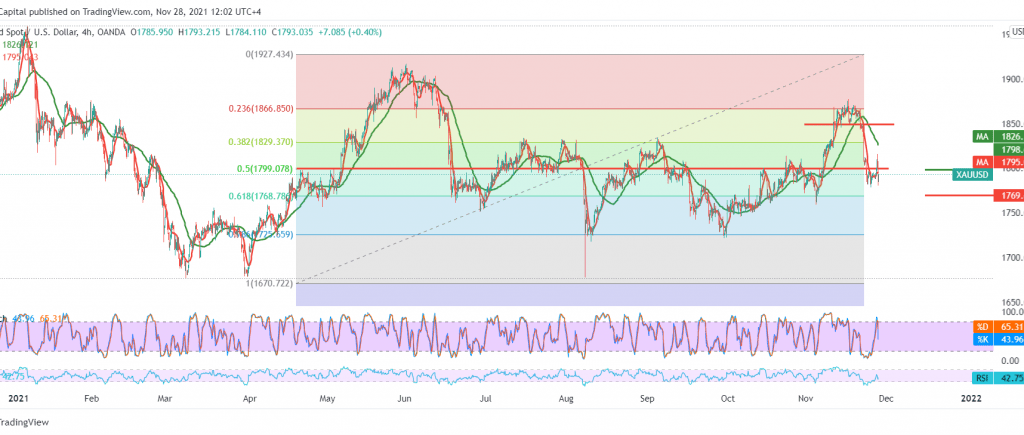

At the end of last week, mixed trading dominated gold prices within an unclear short trend after it managed to break 1797. We explained that trading above the 1804 resistance level might push the price towards 1825, recording a top at 1815 then quickly declining to settle at 1797.

Technically, the price stability below the 1800 barrier and stability below the vital supply area 1797, 50.0% Fibonacci correction, supports the continuation of the bearish trend, as we notice the 50-day moving average is still an obstacle in front of the price.

Therefore, the expected proactive path may be bearish, but with caution, targeting 1770/1773, an initial stop that extends towards 1768, Fibo 61.80%, and therefore requires price stability below 1797 and most notably 1800.

The price behavior should be monitored well if it rises above the resistance level 1800 and 1804 as it will be a sign of an upward bias that targets 1825.

Note: The level of risk is high.

| S1: 1773.00 | R1: 1808.00 |

| S2: 1759.00 | R2: 1829.00 |

| S3: 1738.00 | R3: 1843.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations