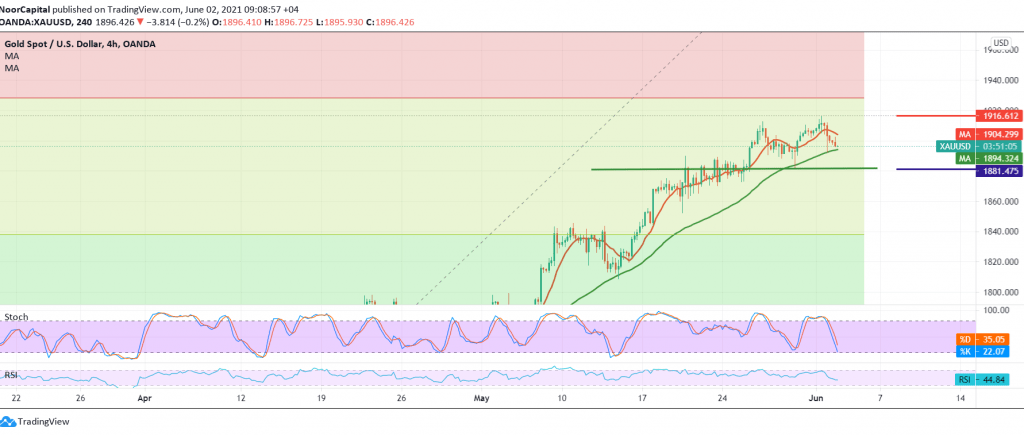

Gold prices succeeded in touching the first bullish target published in the previous analysis, at 1916, recording its highest level at 1916, to return again and hit the resistance level represented by our target, which forced it to trade negatively towards the retest of 1890.

On the technical side today, by looking at the 60-minute chart, we find that the RSI started to lose its bullish momentum, accompanied by the clear negative signs on Stochastic.

The bearish scenario is the most preferred today, targeting 1886 and then 1880 next official station, and it should be noted that the confirmation of breaking 1880 puts the price under strong negative pressure to start its initial targets around 1877 and extend later to visit 1865.

Only from the top, rise again above 1910 and most importantly 1916 will immediately negate the view of decline and gold will restore the bullish path with an initial goal of 1925/1928.

| S1: 1886.00 | R1: 1910.00 |

| S2: 1877.00 | R2: 1925.00 |

| S3: 1862.00 | R3: 1934.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations