Gold prices continued to reach record highs for the fourth consecutive session, hitting a new peak during the previous trading session at $2,671.00 per ounce.

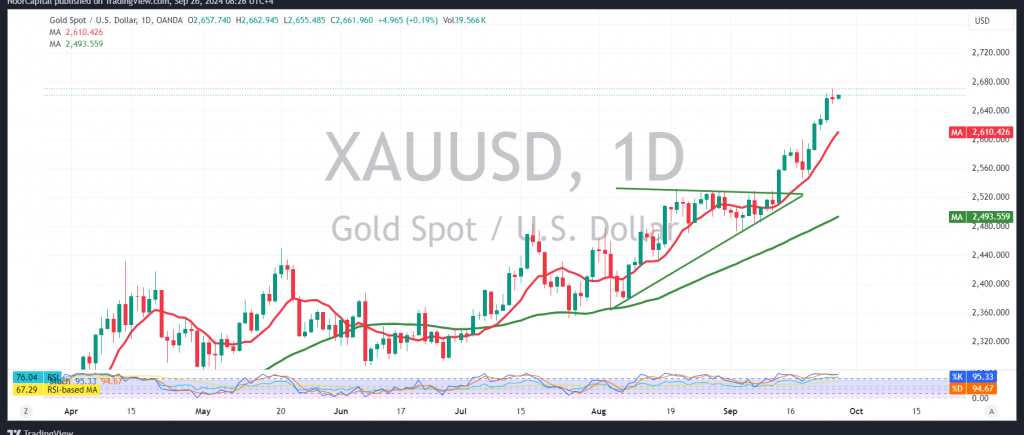

From a technical analysis perspective today, and looking at the 4-hour chart, gold displayed some bearish bias, retesting the previously breached resistance near $2,650. The simple moving averages continue to support the upward price trajectory.

For the bullish scenario to remain valid, we need trading to stabilize above $2,645. An upward breakout and consolidation above the $2,670 peak would strengthen the upward trend, potentially driving the price towards $2,681 and $2,692 as the next targets.

On the downside, a break below $2,645, and more importantly $2,642, could temporarily halt the rise, leading to a minor downward correction targeting $2,629 and potentially extending toward $2,610.

Warning: Risks may be high.

Warning: Today, we are expecting high-impact economic data from the US, including the final reading of GDP prices, unemployment benefits, and a speech by Jerome Powell, Chairman of the Federal Reserve. This could lead to significant price volatility at the time of the news release.

Warning: The level of risk is high amid ongoing geopolitical tensions, and all scenarios are possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations