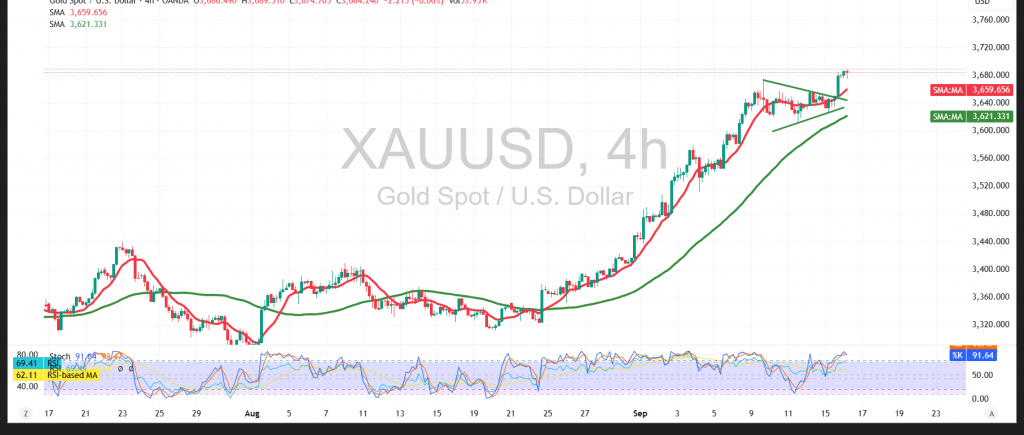

Gold prices (XAU/USD) extended their bullish momentum in the previous session, posting fresh record highs at $3,689 per ounce after surpassing the prior peak of $3,678. This confirms strong buying interest and clear investor control over the prevailing uptrend.

Technical Outlook – 4-hour timeframe:

- Relative Strength Index (RSI): Although firmly in overbought territory, the indicator maintains an upward bias, highlighting the continued dominance of bullish momentum.

- 50-day Simple Moving Average (SMA): Price action remains comfortably above this level, reinforcing the broader positive structure and validating the strength of the daily trend.

Probable Scenario:

Key support for maintaining the bullish outlook lies at $3,648 and more importantly $3,642. A confirmed break above the recent high of $3,689 would increase the probability of further upside, with resistance levels at $3,705 and $3,728 as the next targets.

Conversely:

A decisive break below $3,642 and sustained trading beneath it could trigger temporary selling pressure, opening the door for a retest of support around $3,602 before buyers attempt to reassert control.

Fundamental Note:

Today’s session features high-impact U.S. economic data, including retail sales, alongside Canada’s Consumer Price Index (CPI) readings on both monthly and annual bases. These releases may drive heightened volatility in gold prices.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3642.00 | R1: 3705.00 |

| S2: 3602.00 | R2: 3728.00 |

| S3: 3580.00 | R3: 3768.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations