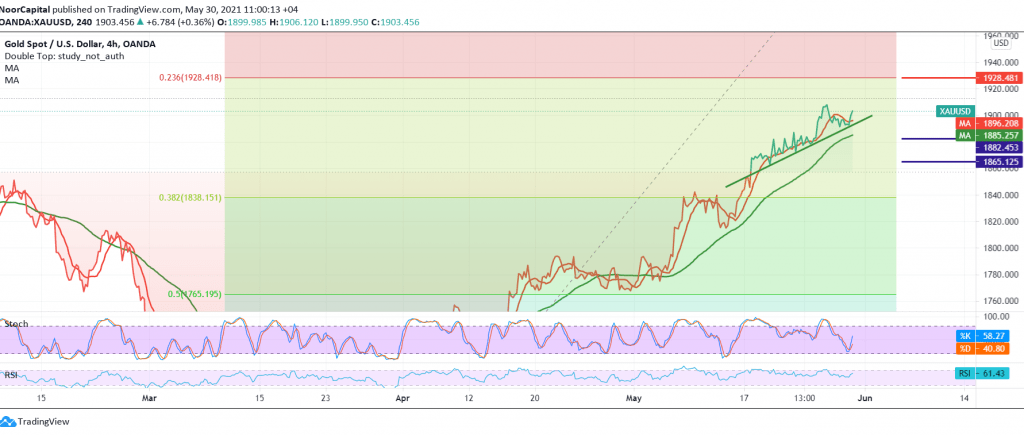

Mixed trading dominated gold prices during the end of last week’s trading, and sideways trading is still limited from below at the support level of 1880 and from upside below the resistance level of 1905.

Technically, today, and by looking at the 4-hour chart, we find that the RSI is stable above the mid-line 50, supporting the continuation of the bullish bias, accompanied by the price getting a positive stimulus from the 50-day moving average, which meets around the pivotal support line 1880/1882.

Therefore, we tend to be positive, but cautiously, targeting 1910/1912, a first target, taking into consideration that the confirmation of the latter’s breach extends the gains to be the next target station, 1821.

To remind that the bullish scenario requires stability in general trading above 1880, and breaking it will immediately stop any attempts to rise and put the price under strong negative pressure, its initial target is 1873 and its second target is 1865.

| S1: 1888.00 | R1: 1912.00 |

| S2: 1873.00 | R2: 1921.00 |

| S3: 1865.00 | R3: 1935.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations