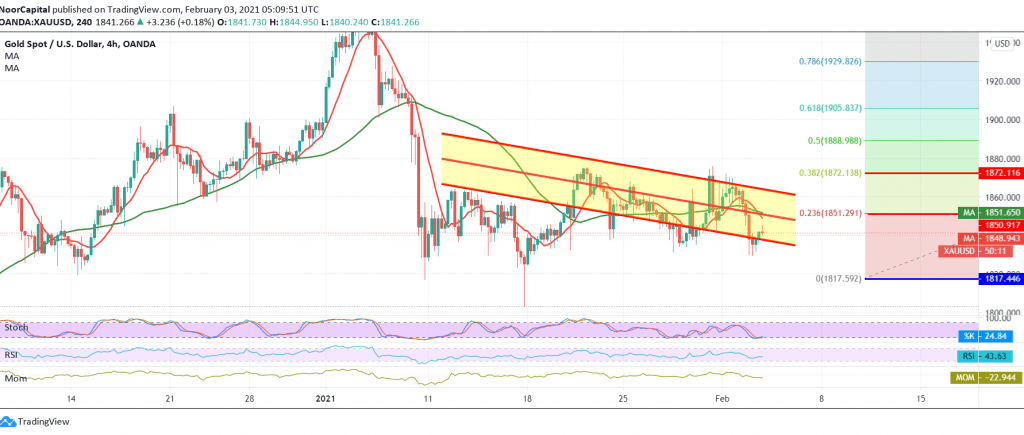

The yellow metal suffered big losses during the previous trading session within the expected bearish path, confirming that the breach of 1851 increases and accelerates the strength of the bearish trend, heading towards touching our official target of 1828.

On the technical side today, and by looking at the 240-minute chart, with the price stabilizing below the previously broken support level of 1851, the 23.60% Fibonacci retracement, we also find the stochastic indicator is providing negative signs that motivate the price to further decline.

From here, the downside scenario will remain a permanent and effective matter, noting that trading below 1828 facilitates the task required to visit 1817, a next official station whose descending targets may extend to 1810.

Going over to the upside and rising again above 1852 and more importantly, 1860 postpones the chances of retreat but does not eliminate them, and we witness a re-test of 1872 before continuing to decline again.

| S1: 1824.00 | R1: 1860.00 |

| S2: 1810.00 | R2: 1872.00 |

| S3: 1789.00 | R3: 1880.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations