Gold is making limited attempts to recover recent losses; however, these efforts are currently facing strong technical resistance near the $3,315 per ounce level.

Technical Outlook:

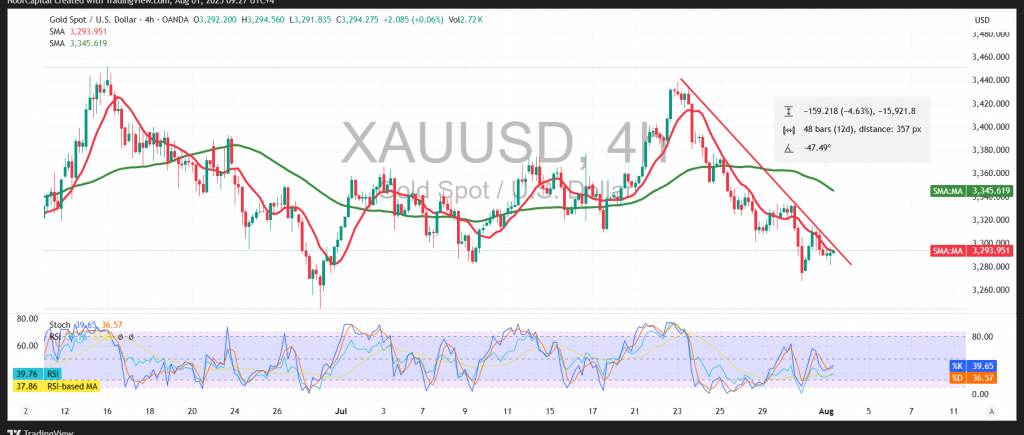

The price is consolidating just below this key resistance area. On the chart, the 50-period Simple Moving Average (SMA) and shorter moving averages continue to act as dynamic resistance barriers. Meanwhile, the Relative Strength Index (RSI) has entered overbought territory on the intraday timeframe, signaling potential exhaustion of any short-term bullish momentum. Price action also remains confined within a well-defined descending channel, reinforcing the broader bearish trend.

Probable Scenario:

Despite short-term rebound potential, the overall technical structure remains bearish. A confirmed break below the $3,285 support level would likely intensify downward momentum, with the next targets seen at $3,274 and $3,256, respectively.

Alternative Scenario:

If the price manages to break and sustain above the $3,315 resistance level, this could trigger a corrective intraday move targeting $3,332. However, such a rebound would be considered temporary unless supported by a broader structural shift.

Key Risk Events – Volatility Alert:

Significant U.S. economic data will be released today, including:

- Non-Farm Payrolls

- Unemployment Rate

- Average Hourly Earnings

These events are expected to generate elevated market volatility, especially for gold and dollar-denominated assets.

Warning:

Risk remains high amid ongoing geopolitical and macroeconomic uncertainties. Traders should be prepared for sharp price swings and manage positions accordingly.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations