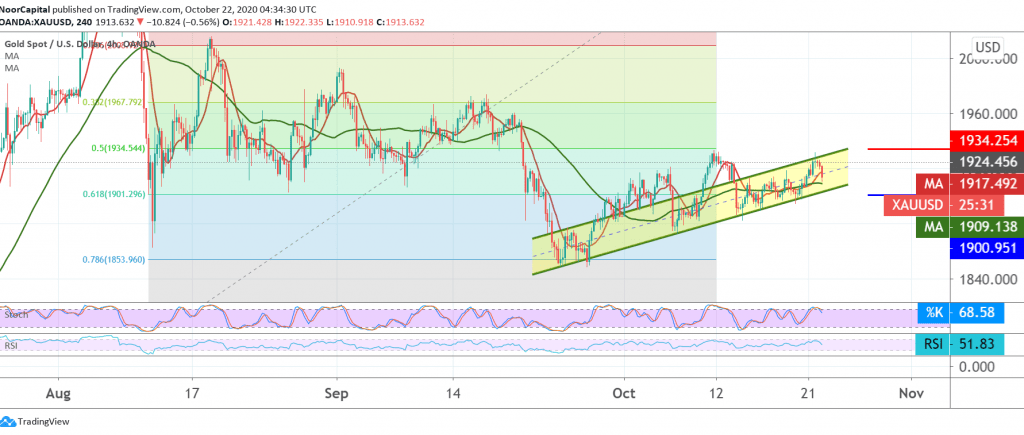

The yellow metal was able to touch the initial target to be achieved, mentioned in the previous report, at 1927, and approached the second target at 1934, but posted a session high at 1931.

Looking at the 240-minute chart, the technical view indicates the possibility of returning the bearish slope in the coming hours, given the negative signs from the stochastic, in addition to RSI losing the bullish momentum, with trading remaining below the pivotal resistance 1934, Fib 50.0%.

Therefore, we may witness a bearish bias during the coming hours, targeting the re-test of 1901 previously broken resistance-into-support, Fib 61.80%, which represents a safety valve for the upside in the short term.

Trading above 1934 negates attempts to retreat and gold regains the bullish path with the initial target 1956.

| S1: 1901.00 | R1: 1927.00 |

| S2: 1893.00 | R2: 1941.00 |

| S3: 1879.00 | R3: 1951.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations