Yesterday, gold experienced a bearish trend, approaching the previously identified support at 2886 and recording a low of 2891.

Technical Outlook

- Chart Patterns:

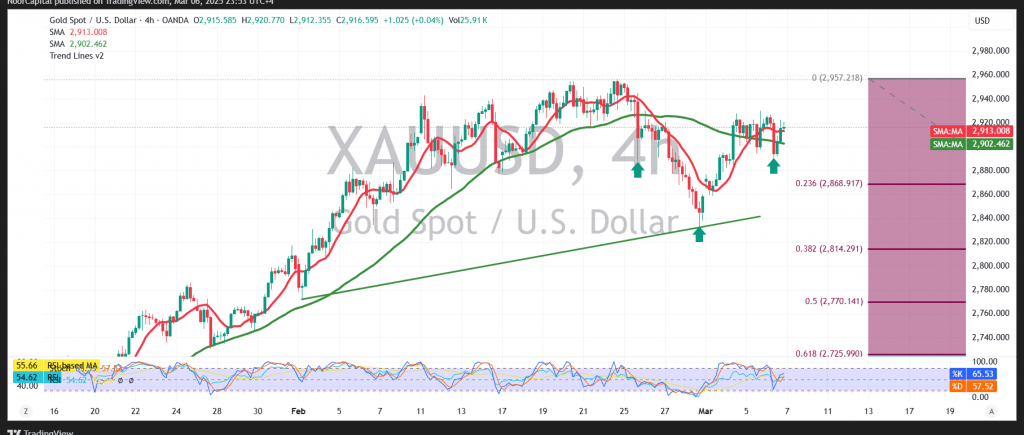

- On the 4-hour timeframe, an ascending technical formation resembling an inverted head and shoulders is visible.

- The simple moving averages continue to support the daily upward trend, even as the Stochastic indicator has started showing negative signals.

- Conflicting Signals & Scenarios:

- Bullish Scenario:

- For the upward trend to continue, gold needs to stabilize above 2894 and break through 2926.

- If this happens, the first target would be 2930, with further gains possible up to 2945.

- Bearish Scenario:

- Conversely, if gold falls below 2894, it may retest lower levels around 2875 and 2868 before attempting another rise.

- Bullish Scenario:

Risk & Disclaimers

- Economic Data Impact:

- Today, high-impact US economic data (including non-farm payrolls, unemployment rates, and average wages) is expected, which may result in significant volatility.

- General Market Risk:

- Ongoing trade tensions and market uncertainties mean all scenarios remain possible.

- CFD Trading Warning:

- Trading on CFDs involves significant risks. The analysis provided is for illustrative purposes only and should not be construed as a recommendation to buy or sell.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations