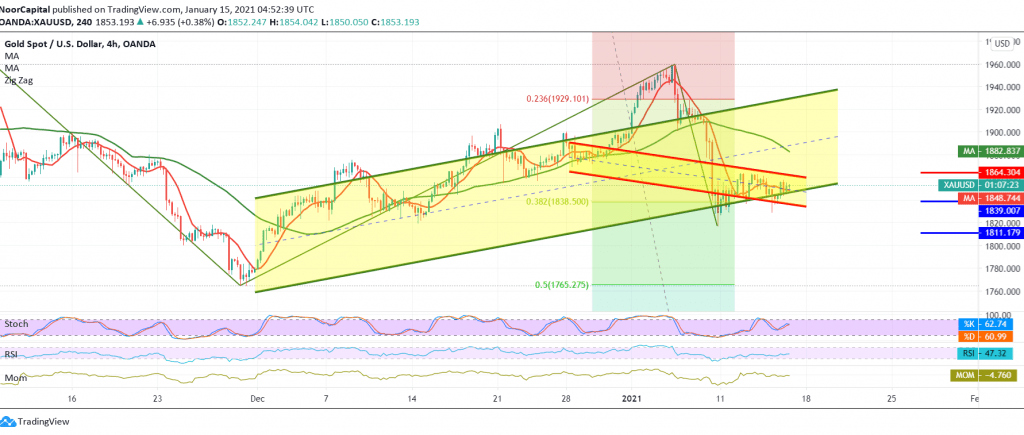

Narrow-range sideways trading that tends to be negative dominates the yellow metal prices within a gradual decline towards the downside, approaching the target required to be achieved at 1823, to settle for the low of 1829.

On the technical side, the price started its morning trading on an upward slope, as a result of stabilizing again above 1837 represented by the 38.20% Fibonacci correction as shown on the chart. This coincides with the beginning of the positive signs appearing on the RSI.

Despite the technical factors that support the occurrence of a bullish tendency in the coming hours, we prefer to wait until the confirmation of the 1863/1864 breakout, as this is a catalyst that strengthens the chances of a rally towards 1874.

In the event that the price fails to surpass the aforementioned resistance and returns to trade again below 1835, we may witness a bearish bias with initial target 1818, while its official target is around 1808.

| S1: 1835.00 | R1: 1863.00 |

| S2: 1818.00 | R2: 1874.00 |

| S3: 1807.00 | R3: 1891.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations