Mixed trading dominated gold prices during the previous trading session, to find the price stable between 1797 and 1815.

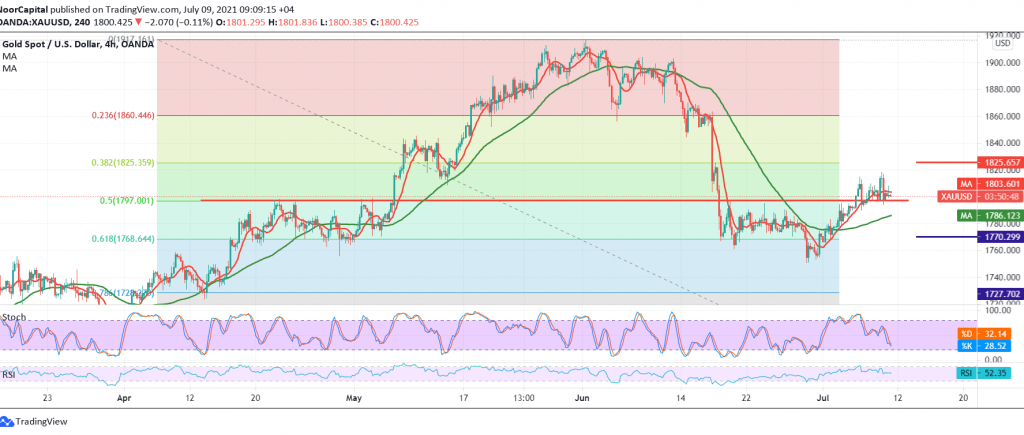

Technically, and carefully looking at the 4-hour chart, we find the 50-day moving average holding the price from below, in addition to the stability of the intraday trading above the strong support level 1797, 50.0% correction, which supports the possibility of a rise.

On the other hand, trading has remained below 1814/1815, in addition to the clear negative features on stochastic, which started to lose the bullish momentum gradually, and that supports the possibility of the downside..

With technical signals conflicting, we will stand aside for the moment in order to obtain a high-quality deal, waiting for one of the following scenarios:

The bearish bias needs price stability above 1797, as we need to witness a clear and strong breach of the 1815 level, and this is a catalyst that enhances the chances of rising to visit 1825, 38.20% correction and 1833.

Activating the selling positions is confirmed by breaking 1797, and this facilitates the mission to visit 1790. It should also be noted that the confirmation of the last break puts the price under strong negative pressure, its initial target is 1788/1777.

| S1: 1790.00 | R1: 1814.00 |

| S2: 1780.00 | R2: 1825.00 |

| S3: 1766.00 | R3: 1838.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations