Gold prices traded positively during the last session, canceling the negative outlook as we expected. We depended on trading stability below the 1799 resistance level to record the highest at 1801.

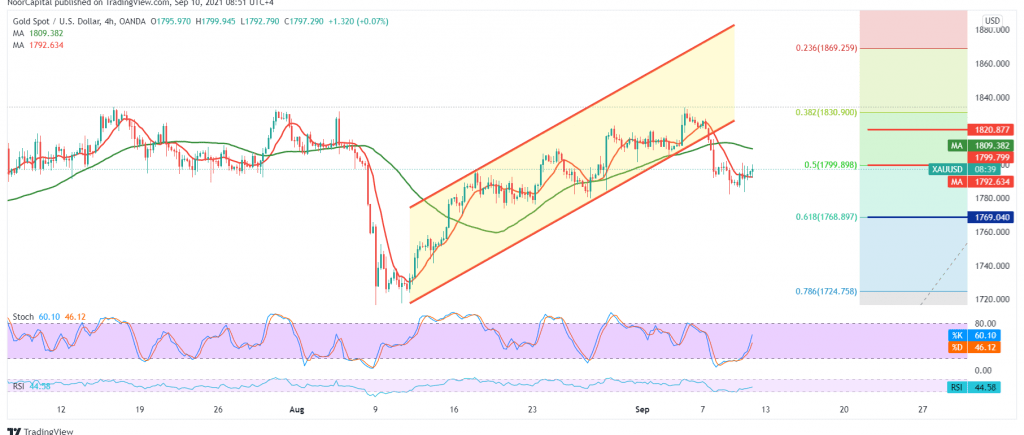

Technically, and by looking at the 240-minutes chart, we find the simple moving averages continue to pressure the price from above; on the other hand, stochastic provides positive signals, accompanied by the stability of the RSI above the mid-line 50.

With technical signals conflicting, we will stand aside for the moment to obtain a high-quality deal, waiting for one of the following scenarios:

Short positions depend on the stability of trading below 1799, 50.0% correction, and 1803. We also need to witness price stability below 1785, which facilitates the task required to visit 1775 and 1768 official stations.

Activating the buying positions requires that we witness the breach of 1803, and this is a catalyst that contributes to strengthening the chances of rising, targeting 1811. The gains may extend later to visit 1820.

Note: The level of risk may be high

| S1: 1785.00 | R1: 1803.00 |

| S2: 1775.00 | R2: 1811.00 |

| S3: 1768.00 | R3: 1821.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations