Mixed trades dominated the movements of the yellow metal in the previous session, to touch the first target to be achieved mentioned in the last analysis at 1956, posting a High at 1959.

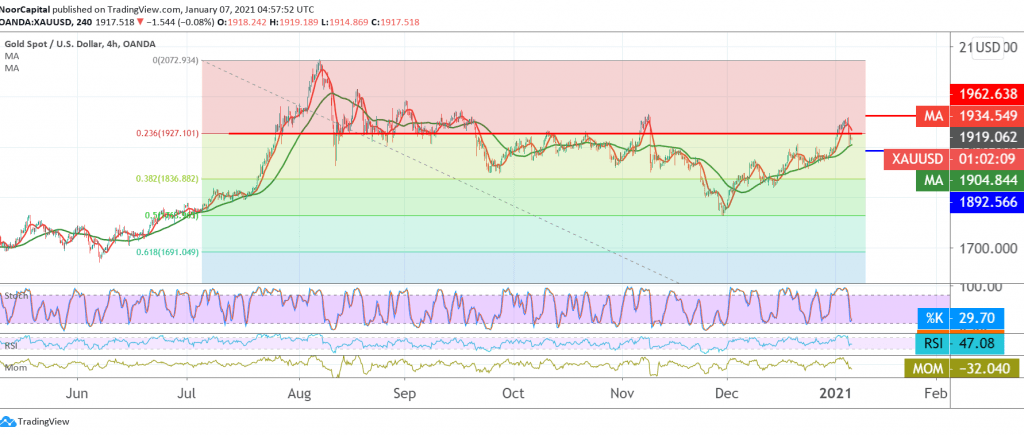

On the technical side, prices witnessed strong declines as a result of approaching the resistance level 1960, which forced the price to re-test the psychological barrier support 1900, by looking at the chart, we find the price is currently stable below 1927 Fibonacci retracement 23.60%, in support of the continuation of the bearish tendency that started yesterday, on the other side, the 50-day moving average is holding the price from below around 1900, which represents the key to protecting the upside move.

From here, and with the conflict of technical signals, we will stand on the fence, for a moment, expecting one of the following scenarios:

The activation of short positions depends on the stability of trading below 1927. We also need to witness a clear and strong break of the 1900 support level, which puts the price under strong negative pressure, its initial target is around 1891 and extends later towards 1865.

Reactivating long positions requires stability of trading above 1927 and then 1935, and from here the price regains its recovery target of 1950 and extends to 1960.

Note: The level of risk may be high.

| S1: 1891.00 | R1: 1950.00 |

| S2: 1865.00 | R2: 1984.00 |

| S3: 1832.00 | R3: 2009.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations