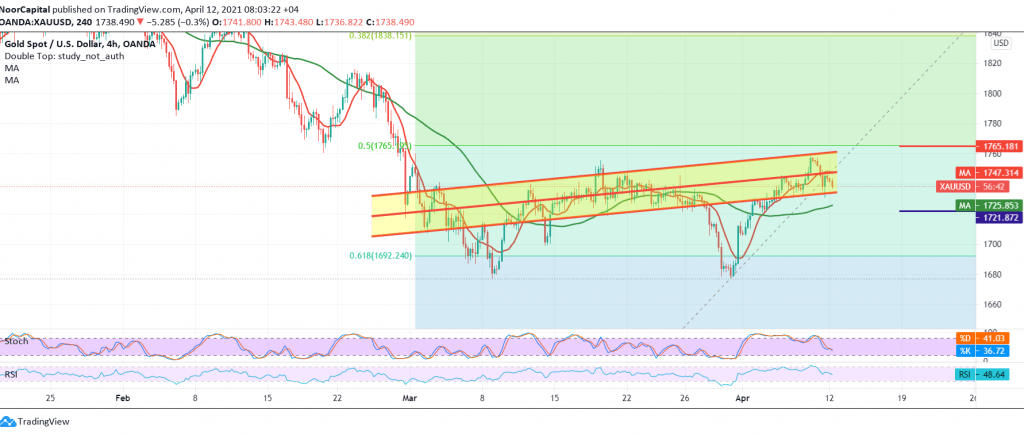

Gold prices started their first weekly session with a bearish bias, as a result of hitting the resistance level 1758, in order for the current moves to stabilize below the aforementioned level.

Technically speaking, the clear signs of negativity on Stochastic support the occurrence of a bearish bias during the coming hours, in addition to the stability of the RSI below the 50 midline.

Therefore, we may witness a bearish bias during the next few hours, targeting 1727 first target, bearing in mind that confirming the last break extends gold’s losses so that we will be awaiting touching 1716 next stops.

From the top, surpassing the upside and rising above 1753 is capable of aborting the expected bearish bias, and gold regains its recovery with an initial target that starts at 1765, Fibonacci retracement of 50.0%.

| S1: 1727.00 | R1: 1753.00 |

| S2: 1716.00 | R2: 1768.00 |

| S3: 1701.00 | R3: 1779.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations