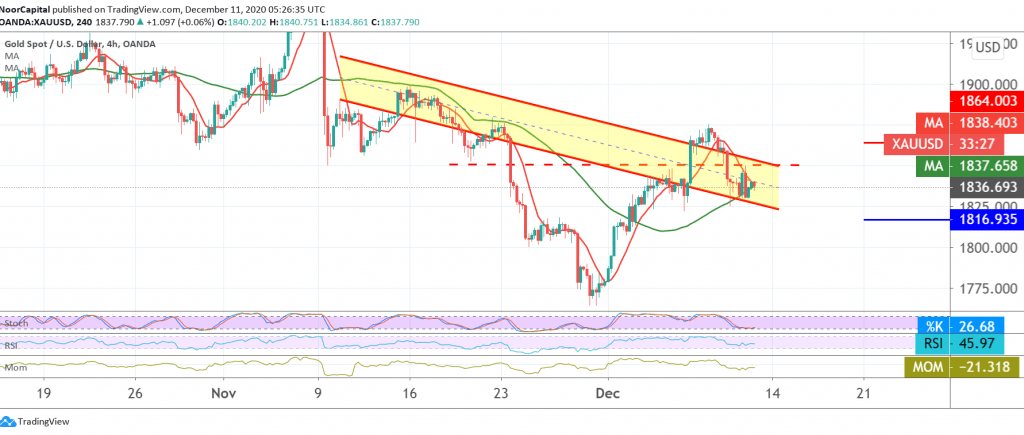

The technical outlook remains unchanged, and gold’s movements have not changed significantly, maintaining the bearish bias, stable below the 1850 resistance level.

Technically speaking, and with a closer look at the 240-minute chart, the signs of negativity are still dominating the stochastic, and this comes in conjunction with the RSI gaining bearish momentum over the short time intervals.

From here, with the stability of intraday trading below 1850 and most importantly 1865, this encourages us to maintain our negative outlook targeting 1825/1820, bearing in mind that trading below the aforementioned level extends gold’s losses, opening the way directly towards re-testing the support level of 1816 and may extend later towards 1805.

From the top, surpassing the resistance level of 1865 is capable of negating the suggested bearish scenario and leads gold to a bullish path targeting 1870, to extend later towards 1883.

| S1: 1825.00 | R1: 1848.00 |

| S2: 1816.00 | R2: 1860.00 |

| S3: 1805.00 | R3: 1870.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations