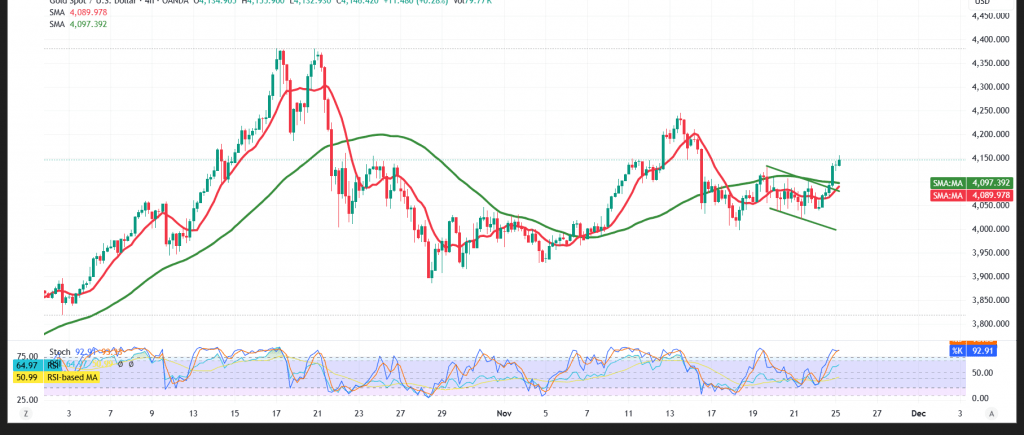

Gold prices (XAU/USD) rebounded after stabilizing above the $4040 support level, moving decisively through the $4100 barrier.

Technical Outlook – 4-Hour Timeframe

The simple moving averages have shifted into supportive zones, acting as dynamic support and enhancing the potential for further upside. The RSI maintains its positive structure, signaling solid bullish momentum. Although nearing overbought territory, this may slow the pace of gains without undermining the broader upward trend.

Most Likely Technical Scenario

The bias remains bullish, with a confirmed break above $4155 expected to open the door for additional gains, targeting $4185 as the next key level.

However, a drop back below $4100 could trigger temporary downside pressure, leading to a retest of $4070, followed by $4060.

Note

Significant U.S. economic data is due today, particularly the monthly and annual Producer Price Index (PPI), which could introduce heightened volatility at the time of release.

Risk Disclaimer

Gold carries a relatively high risk in the current trade and geopolitical environment, and price swings may be unsuitable for some investors.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 4070.00 | R1: 4185.00 |

| S2: 4000.00 | R2: 4227.00 |

| S3: 3955.00 | R3: 4300.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations