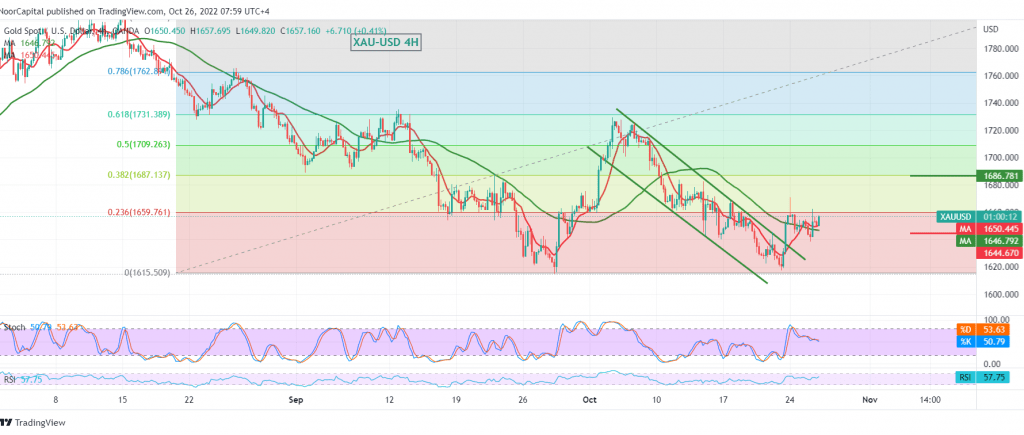

Gold attempts continue to rise, but still limited attempts are ineffective after a strong confrontation with the pivotal resistance level published during the previous analysis at1660 price, which still constitutes an obstacle to the price until now, unable to break it.

On the technical side, and by looking at the chart with a 240-minute-chart the positive motive coming from the 50-day simple moving average, which started holding the price from below, and on the other hand, we find the negative signs that started to appear on the stochastic that started to lose the bullish momentum gradually.

With technical signals conflicting, we prefer to monitor the price behaviour to be in front of one of the following scenarios:

Consolidation above 1660 motivates the price to visit 1666 first target, then 1677 the second target, and it should be noted that attempts to breach 1677 may extend gold’s gains so we are waiting for 1686 next price stations.

The failure of gold to break 1660 with a return below 1642 leads gold to resume the descending path, and we wait for an ounce of gold around 1628 initially, which may extend later towards 1617.

Note: A positive technical structure is ongoing.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations