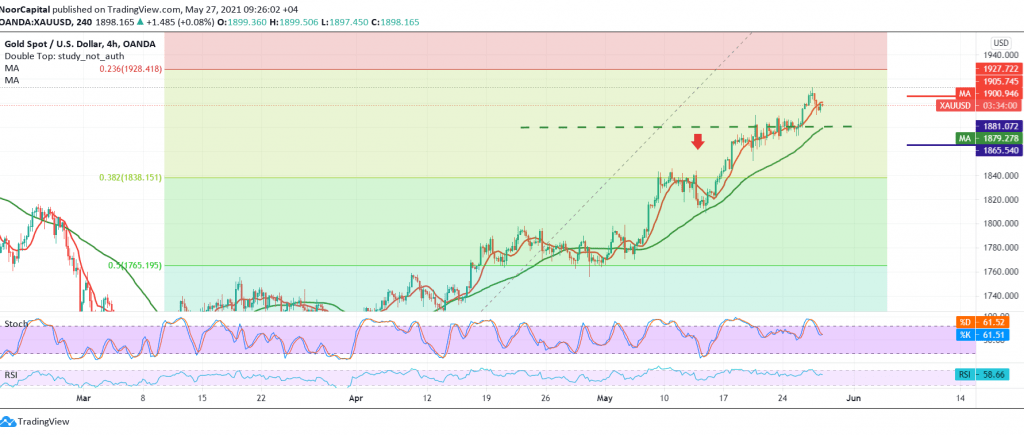

Gold prices approached touching the first target required and mentioned in the previous analysis located at 1917, to settle for recording its highest level at 1912, finding it difficult to surpass the aforementioned level, which forced it to move within a bearish path.

On the technical side today, and by looking at the 60-minute chart, we find the current moves are stable below the psychological barrier of 1900, in addition to the clear negative signs on the stochastic indicator.

On the other hand, we find the 50-day moving average is still holding the price from below, and it meets around 1880/1879 and adds more strength, supporting the return of the bullish bias again.

We find it difficult to determine the next intraday direction, and therefore we prefer to wait until the pending orders are activated. Activating the selling positions needs to witness a clear and strong break of the support level of 1880, which facilitates the task required to visit 1877 and then 1870, bearing in mind that breaking the latter may extend gold’s losses, opening the way to 1865.

Activating long positions requires the return of stability of trading again above 1905 and most importantly 1909, thus gold regaining its recovery to target 1921 and 1927, respectively.

| S1: 1887.00 | R1: 1909.00 |

| S2: 1877.00 | R2: 1921.00 |

| S3: 1865.00 | R3: 1931.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations